利用可能な資産

手数料とコミッション

取引プラットフォーム

ツールと機能

ライセンスと規制

教育資料

アカウントの種類

カスタマーサポート

入金と出金

2024年のTopBrokers360 Pepperstoneレビュー

詳細なPepperstoneのレビューでは、競争力のあるスプレッドと1200以上の金融商品を提供するブローカーについて詳しく探ります。このブローカーは魅力的な価格設定だけでなく、最低入金額なしでトレーダーを歓迎する手軽なエントリーポイントでも際立っています。2010年にプロのトレーダーチームによって設立され、リマソール、デュッセルドルフ、ロンドン、メルボルン、ドバイ、ナイロビにオフィスを構えるなど、急速にグローバルな存在感を拡大しています。Pepperstoneの卓越した顧客サービスへのコミットメントは、カスタマイズされた教育ガイド、独自のインサイト、強力な取引ツールを通じてトレーダーをサポートする姿勢に現れています。

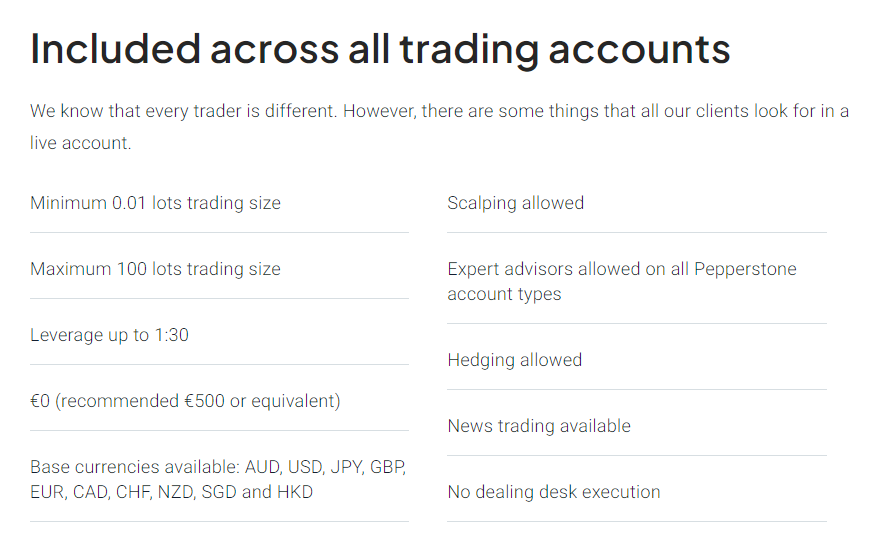

Investment Trends、Deloitte、UK Forex Awardsなどの著名な組織からの賞賛は、顧客サービス、取引条件、優れたコストパフォーマンスへの献身を裏付けています。トレーダーは透明な価格設定、迅速な注文執行、複数の管轄区域での規制遵守、FX、CFD、商品などの多様な取引商品へのアクセスを期待できます。受賞歴のある顧客サポート、豊富な取引リソース、シームレスなアカウント体験を備えたPepperstoneは、トレーダーが成功に集中できるようサポートします。

長所と短所

長所:

- 鋭いスプレッド

- 広範な商品レンジ

- 低い最低入金額

- 高速注文執行

- 複数の取引プラットフォーム

短所:

- 限定されたアカウントタイプ

- 暗号通貨取引なし

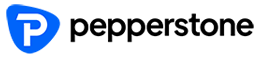

Pepperstoneのプラットフォーム

Pepperstoneブローカーは、各取引ニーズや好みに合わせた業界トップの取引プラットフォームを提供しています。

MetaTrader 4 (MT4)

MetaTrader 4は、その使いやすいインターフェースと強力な機能で知られており、あらゆる経験レベルのトレーダーに最適です。MT4は、インタラクティブチャート、テクニカルインジケーター、そして自動取引戦略のためのExpert Advisor機能など、様々な分析ツールを提供します。その広範な人気により、豊富なチュートリアルリソースとコミュニティサポートが保証されています。

MetaTrader 5 (MT5)

MT4の進化版であるMetaTrader 5は、より深い取引ツールを求めるトレーダーのために拡張された機能を提供します。MT5は、より多くの注文タイプをサポートし、より多くの内蔵テクニカルインジケーターと時間枠を提供し、より詳細な分析のために改善されたチャートツールを提供します。また、リアルタイムで市場動向を知らせる統合された経済カレンダーも特徴としています。

cTrader

cTraderは、その洗練されたインターフェースと高度な注文機能で特に経験豊富なトレーダーに人気があります。このプラットフォームは、透明な取引体験のためのレベルII価格設定と完全な市場深度を提供します。さらに、cTraderはC#を使用して取引ボットを作成およびカスタマイズするためのcAlgoによる自動取引もサポートします。

TradingView

TradingViewは、取引とソーシャルネットワーキングを統合し、トレーダーのグローバルコミュニティ内で戦略や洞察を共有できる点で独特です。このプラットフォームは、幅広いデータフィードとテクニカル分析をサポートする優れたチャートツールを備えています。TradingViewは、その直感的なデザインとPepperstoneとの直接接続機能により、シームレスな取引を可能にします。

画像ソース: Pepperstone ブローカー取引プラットフォーム

- すべてのプラットフォームでの迅速な注文執行

- MetaTraderとcTraderのカスタマイズ可能なインターフェースInterfaces on Metatrader and Ctrader

- TradingViewとMetaTraderの高度なチャートツール

- cTraderとTradingViewのチャートベースの取引機能

- MetaTraderプラットフォーム上の広範な分析ツール

- すべてのプラットフォームで利用可能な強力なチャートおよび分析オプション

- MetaTrader 5に統合された経済カレンダー

- MetaTraderとcTraderでの自動取引のためのExpert AdvisorsとCalgo

- 意思決定を強化するためのMetaTraderとcTraderでの広範な分析リソース

- プラットフォーム上で直接アクセス可能なリアルタイムの市場更新およびニュース

多様な市場アクセス

ブローカーは、さまざまな投資嗜好や戦略に対応する広範な取引製品を提供しています。主要、マイナー、エキゾチック通貨ペアを含む高い流動性の外為取引から、コモディティ、指数、暗号通貨のダイナミックな領域まで、トレーダーはポートフォリオを大幅に多様化することができます。さらに、Pepperstoneは、シェアCFDを通じてグローバル株式市場へのアクセスを提供し、貴金属、エネルギー、債券の分野での取引機会も提供しています。

CFD取引商品:

外為:

- 主要、マイナー、エキゾチックを含む70以上の通貨ペアを競争力のあるスプレッドで取引できます。

指数:

- 手数料なしで20以上の主要なグローバル指数にアクセスでき、レバレッジオプションも利用可能です。

コモディティ:

- 金や銀のような金属、原油や天然ガスのようなエネルギー製品、コーヒーや砂糖のようなソフトコモディティを取引できます。

暗号通貨:

- ビットコイン、イーサリアム、その他の人気デジタル通貨で暗号通貨取引ができます。

株式:

- 米国、欧州、アジア市場の株式CFDを通じて世界の主要企業に投資できます。

貴金属:

- 市場のボラティリティに対するヘッジや投機的投資として、金、銀、その他の貴金属を取引できます。

エネルギー:

- 原油や天然ガスのCFDを通じてエネルギーセクターにアクセスし、価格変動を利用できます。

債券:

- 株式に比べてリスクが低い投資として、さまざまな政府および企業の債券を利用して多様化できます。

CFD:

- 急速に変動するグローバル金融市場の価格上昇や下降を投機するためにCFDを使用して取引戦略を拡大できます。

ETF:

- 一つの取引で証券、コモディティ、債券のコレクションにエクスポージャーを得ることができる上場投資信託をPepperstoneブローカーを通じて利用できます。

Pepperstoneのログインとアカウント選択肢

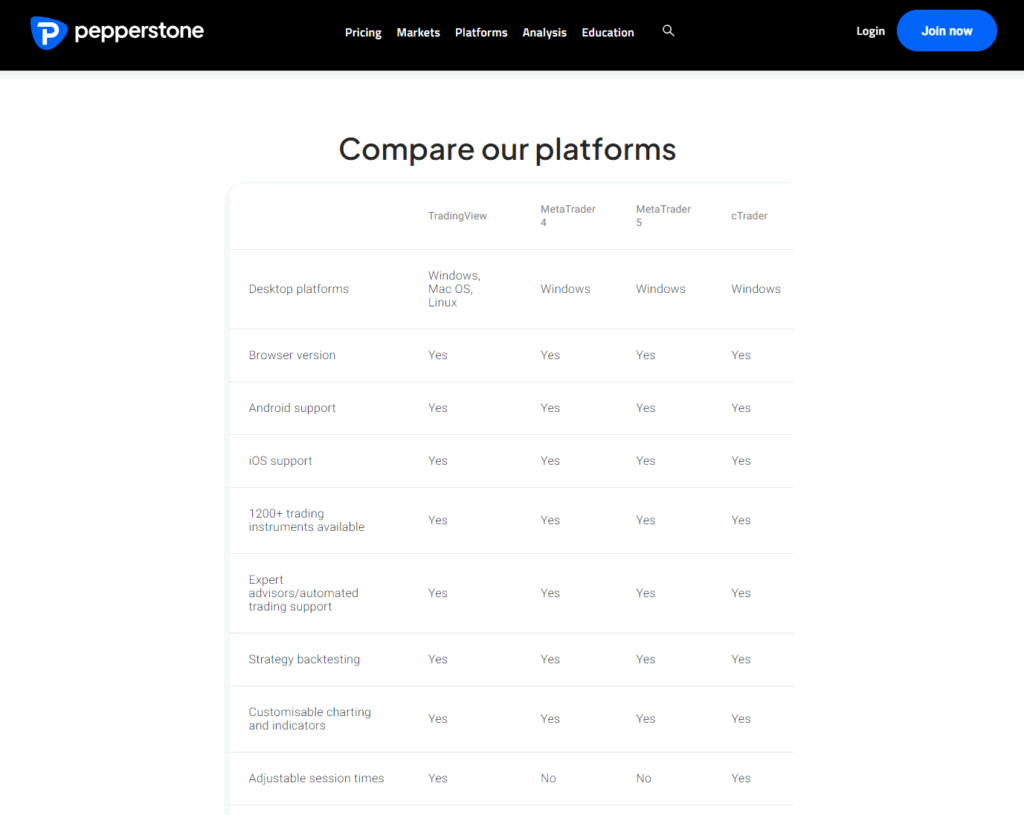

ブローカーは、提供される主要な2つの取引アカウントタイプ、RazorアカウントとStandardアカウントのための簡単なログインとサインアッププロセスを備えています。

Razorアカウント: このアカウントタイプは、低スプレッドを重視し、取引に対して手数料を支払うことに慣れているトレーダーに好まれます。特に、スキャルピングやアルゴリズム取引を行うトレーダーにとって理想的で、原スプレッドが0ピップスから始まる低コスト構造を提供しています。RazorアカウントはECN価格モデルを採用しており、タイトなスプレッドと高い流動性を保証します。

Standardアカウント: よりシンプルなコスト構造を好むトレーダーに適しており、取引コストがスプレッドに組み込まれています。スプレッドはRazorアカウントよりもわずかに広いですが、それでも非常に競争力があります。このアカウントタイプはそのシンプルさから、新しいトレーダーにしばしば推奨されます。

両方のアカウントは最大1:30のレバレッジを提供し、さまざまな取引スタイルや戦略をサポートします。各アカウントは同じプラットフォームと商品へのアクセスを提供し、全てのトレーダーがブローカーの全てのツールとサービスを利用できるようにしています。これには、エキスパートアドバイザーのサポート、ヘッジング、およびスキャルピング戦略も含まれます。

画像の出典: Pepperstoneブローカーの取引アカウントのレビュー

Pepperstoneのグローバル基準

Pepperstoneは、複数のトップティア金融当局によって徹底的に規制されており、高い透明性と信頼性を確保しています。これには、オーストラリアのASIC、ドイツのBaFin、ケニアのCMA、キプロスのCySEC、およびドバイのDFSAによる監督が含まれます。国際的な金融基準への準拠は、トレーダーを保護するだけでなく、運営の信頼性を高め、外為およびCFD取引コミュニティにおいて信頼される名前となっています。

Pepperstoneの最低預金額と支払い方法

効率的かつ安全な資金管理システムは、最低預金額を$0に設定しており、すべてのレベルのトレーダーがアクセス可能です。VisaおよびMastercardのデビット/クレジットカード、PayPal、銀行振込など、さまざまな支払い方法を用意しており、追加料金なしで利便性を提供しています。出金時間は通常1〜3営業日で迅速です。ブローカーの資金保護へのコミットメントは、顧客資金を信頼できる銀行に分別管理し、英国の補償スキームFSCSのメンバーであることからも明らかです。透明性が重要であり、潜在的な銀行手数料の明確な開示と規制の厳格な遵守、特に詐欺リスクを軽減するための第三者支払いの禁止が徹底されています。顧客サポートのために、Pepperstoneは広範なFAQとアクセス可能なチャネルを提供しており、シームレスな資金管理体験を保証します。

サポート

Pepperstoneのサポート体制は、応答性とアクセスのしやすさで際立っており、クライアントにさまざまな支援オプションを提供しています。詳細なFAQセクションを含むことで、一般的な質問に対する即時の解決策を提供しています。個別のサポートが必要な場合、クライアントはメールでアクセス可能な専用のサポートチームを利用できます。緊急の状況では、顧客サポートホットラインにより、重大な問題を即座に解決することができます。

Pepperstoneの受賞歴のあるグローバルなプレゼンスで国境を超えて取引しましょう

画像の出典: Pepperstoneの受賞歴のあるサービス

Pepperstoneは良いブローカーですか?

Pepperstoneは、トレーダーに幅広い資産、競争力のある手数料、直感的な取引プラットフォームを提供する優れたブローカーとしての地位を確立しています。堅実な規制枠組み、豊富な教育リソース、応答性の高い顧客サポートにより、このブローカーは信頼性と信頼を得ています。包括的な教育資料から応答性の高い顧客サポートまで、Pepperstoneはすべてのレベルのトレーダーが金融市場を自信を持ってナビゲートできるようにサポートしています。

よくある質問

1. Pepperstoneはどこの国のものですか?

ブローカーの本社はキプロスのリマソールにありますが、Pepperstone Group Limitedというグローバルに展開する企業が所有しています。

2. Pepperstoneの出金はどれくらい早いですか?

出金時間は、選択した出金方法によって通常1〜3営業日です。

3. Pepperstoneの入金にかかる費用は?

Pepperstoneは入金に対して手数料を課しませんが、顧客の銀行や支払いプロバイダーが手数料を請求する場合があります。

4. Pepperstoneでオプション取引はできますか?

いいえ、ブローカーは主に外為とCFD取引に焦点を当てており、オプション取引は提供していません。

5. Pepperstoneは安全ですか?

はい、PepperstoneはCYSEC、ASIC、DFSA、BAFIN、CMAなど、複数の金融当局によって規制されているため、安全と見なされています。

6. Pepperstoneではスキャルピングは許可されていますか?

はい、スキャルピングは許可されており、トレーダーがさまざまな取引戦略を実行できる柔軟性を提供しています。

7. Pepperstoneからの出金方法は?

ブローカーから資金を引き出すには、顧客が安全なクライアントエリアにログインし、資金タブに移動して出金リクエストを開始します。

8. Pepperstoneの最大レバレッジは?

最大レバレッジは、規制制限に従って最大1:30です。

9. Pepperstoneは初心者に適していますか?

はい、使いやすいプラットフォーム、豊富な教育リソース、応答性の高いカスタマーサポートにより、初心者トレーダーが金融市場の複雑さをナビゲートするのに適しています。