A TopBrokers360 Exness Review for 2023

Meet Exness, a globally recognized name in the online trading industry. Headquartered in Limassol, Cyprus, this broker has made a name for itself by offering secure and transparent trading services worldwide.

But what sets Exness apart? First and foremost, client safety and security are taken very seriously. Regulated by several leading international governing bodies, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and more, Exness ensures that your investments are in trusted hands.

With a strong focus on transparency and a commitment to client protection, Exness has become a go-to choice for traders looking to confidently navigate the financial markets. The broker has been designed with user-friendliness in mind, making it suitable for new and seasoned traders.

In this broker review, we will take a closer look at what Exness has to offer, examining the various account types, trading platforms, and other key features that make it a preferred choice among traders. We invite you to join us as we explore the many reasons why Exness can be the ideal broker for your needs.

Pros and Cons

Pros:

- Regulated

- User-Friendly Platforms

- Low Deposits

- Diverse Accounts

- Transparent Fees

- 24/7 Support

- Social Trading

Cons:

- Limited Instruments

- Basic Education

The Exness Trading Platforms

Now let’s take a look at the range of trading platforms offered by Exness that cater to the diverse needs of different traders:

Available Trading Platforms:

Exness Trade App

The Exness Trade app is a user-friendly mobile platform that allows traders to access their accounts, monitor the markets, and execute trades on the go. It offers convenience and flexibility for traders who prefer mobile trading.

Image source: Exness Trade App

Exness Terminal

Exness Terminal is a versatile trading platform designed for desktop use. It provides advanced charting tools, technical indicators, and a seamless experience. It is an excellent choice for traders who require comprehensive features and functionality.

Image source: Exness Terminal

MetaTrader 5

MetaTrader 5 (MT5) is a powerful and widely recognized trading platform. It offers a wide range of instruments, advanced analysis tools, and automated trading capabilities. MT5 is suitable for traders who require a robust platform with extensive features.

Image source: MetaTrader 5 on Exness

MetaTrader 4

MetaTrader 4 (MT4) is a well-established platform known for its simplicity and effectiveness. It offers real-time charts, technical analysis tools, and support for algorithmic trading through Expert Advisors (EAs). MT4 is favored by both beginners and experienced traders.

Image source: MetaTrader 4 on Exness

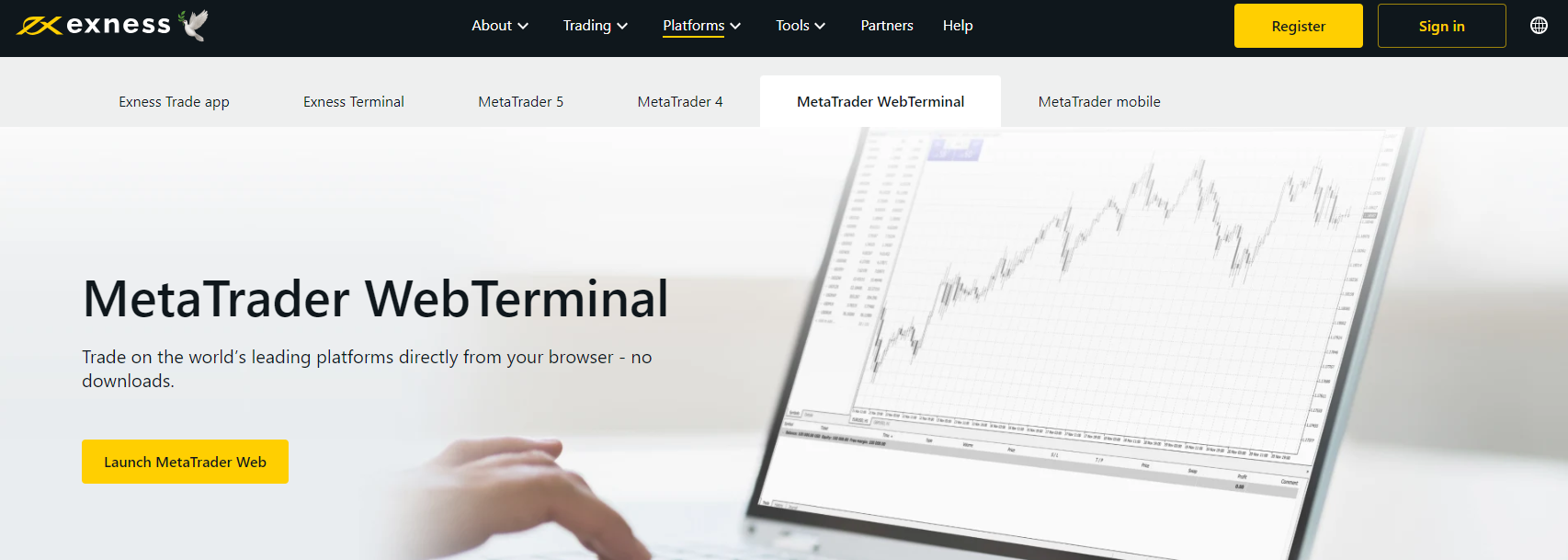

MetaTrader WebTerminal

The MetaTrader WebTerminal is a web-based platform that allows traders to access their accounts and trade directly from their web browsers. It offers convenience without the need for software installation.

Image source: Exness MetaTrader WebTerminal

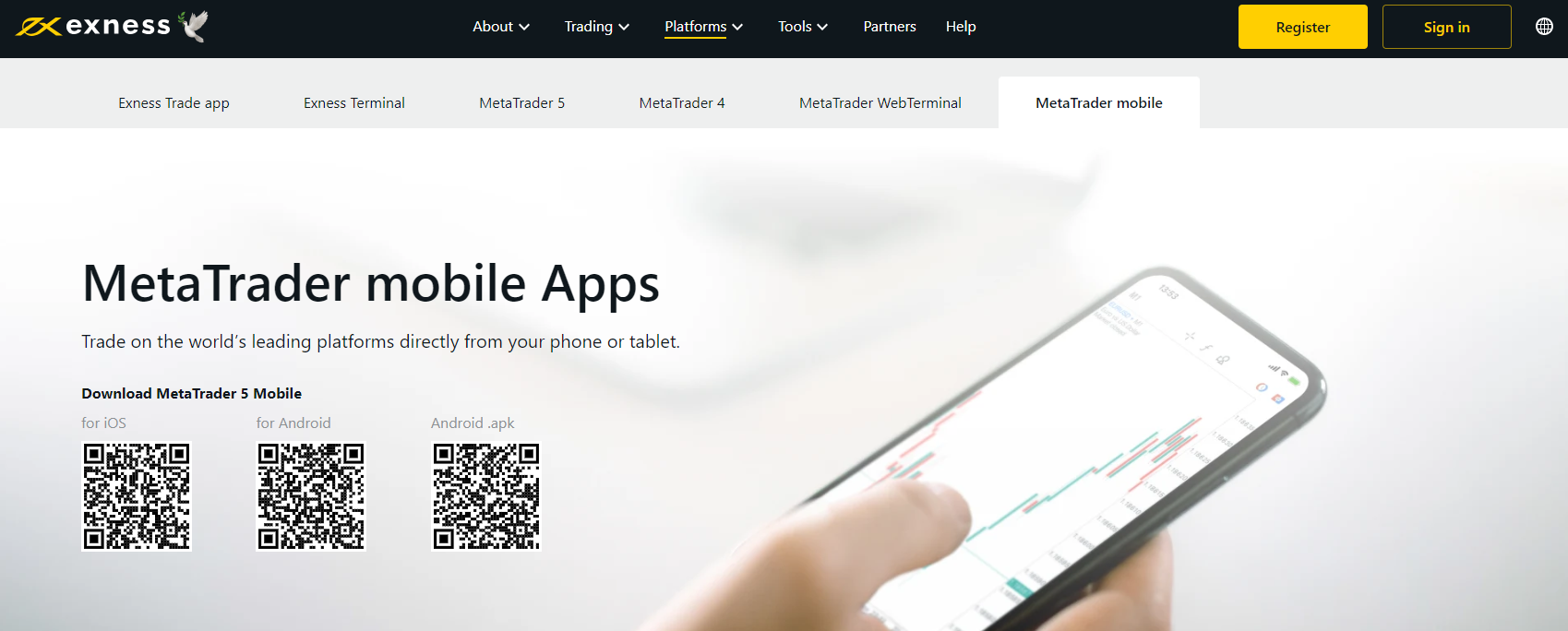

MetaTrader Mobile

MetaTrader Mobile is a mobile trading platform compatible with both MT4 and MT5. It provides traders with the flexibility to manage their trades and portfolios on smartphones and tablets.

Image source: Exness MetaTrader Mobile Apps

With a variety of trading platforms at your disposal, Exness ensures that users have the tools they need to execute their strategies effectively.

- Choose from various account types, including Standard, Raw Spread, Zero, Pro, Social Standard, and Social Pro.

- Enjoy ultra-low spreads, starting from as low as 0.0 pips on some accounts.

- Access trading instruments, including Forex, cryptocurrencies, stocks, commodities, and indices.

- Take advantage of leverage options of up to 1:200 to amplify your trading potential.

- Share strategies or copy trades with Social Trading accounts, including Social Standard and Social Pro.

- Benefit from no-commission trading on Standard accounts and competitive commissions on Pro accounts.

An Exness Review of their Available Instruments

Exness offers a diverse range of CFDs (Contracts for Difference) that encompass various asset classes. These include:

Forex: Exness provides access to a wide selection of currency pairs, allowing traders to participate in the global Forex market. With over 100 currency pairs, including majors, minors, and exotics, you'll find ample opportunities to trade in the Forex arena.

Commodities: Traders interested in commodities can explore precious metals like gold and silver, as well as popular energies such as crude oil and natural gas. These CFDs offer a chance to diversify portfolios and speculate on the price movements of essential commodities.

Stocks: The inclusion of stock CFDs enables traders to engage with the equity markets. Exness provides access to a variety of stocks from global exchanges, allowing traders to invest in companies they believe in.

Cryptocurrencies: For those interested in the world of digital assets, Exness offers a selection of cryptocurrency CFDs. This category covers a range of popular cryptocurrencies, providing exposure to the crypto market's volatility.

Indices: Traders can speculate on the performance of stock market indices, including major global indices such as the S&P 500, FTSE 100, and more. This offers a broader perspective on the financial markets.

From major and minor Forex pairs to a variety of commodities, stocks, cryptocurrencies, and indices, the broker provides a wealth of trading opportunities. Whether you are focused on a specific asset class or looking to diversify your portfolio across different markets, Exness' range of CFDs offers versatility to traders of all levels.

Comparing the Trading Accounts Offered by Exness

Exness offers different account types to suit the various trading styles and preferences of their users as well as a demo account.

Below, we offer a comparison of their primary account types: Standard, Professional, and Social Trading.

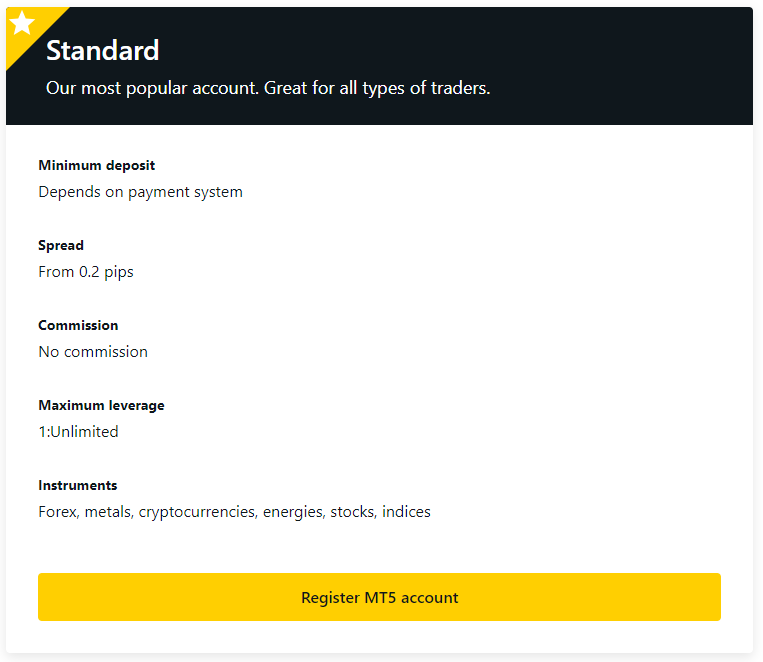

1. Standard Account:

Ideal For: Traders of all levels, including beginners

Minimum Deposit: Variable, depending on the payment method

Spreads: Starting from 0.2 pips

Commissions: None

Trading Instruments: Forex, metals, cryptocurrencies, energies, stocks, indices

Order Execution: Market execution for swift and reliable trades

Leverage: Up to 1:Unlimited

Trading Platforms: MT4, MT5

Image source: Exness Standard Account

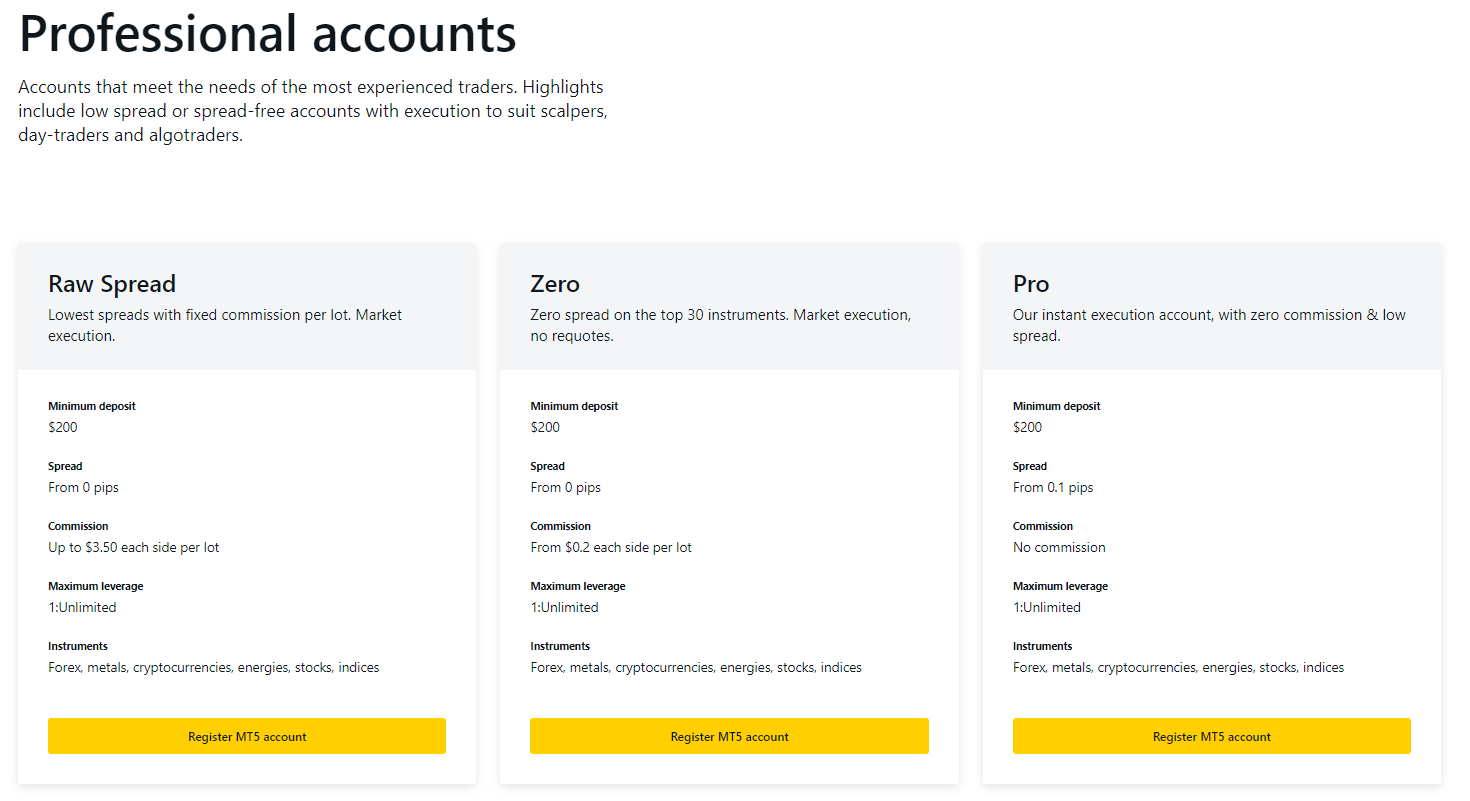

2. Professional Accounts:

Ideal For: Experienced traders seeking low spreads and advanced features

Minimum Deposit: $200

Spreads: From 0 pips

Commissions: Up to $3.50 each side per lot for Raw Spread, from $0.2 each side per lot for Zero, and no commission for Pro

Trading Instruments: Forex, metals, cryptoсurrencies, energies, stocks, indices

Leverage: 1:Unlimited

Trading Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

Image source: Exness Professional Accounts

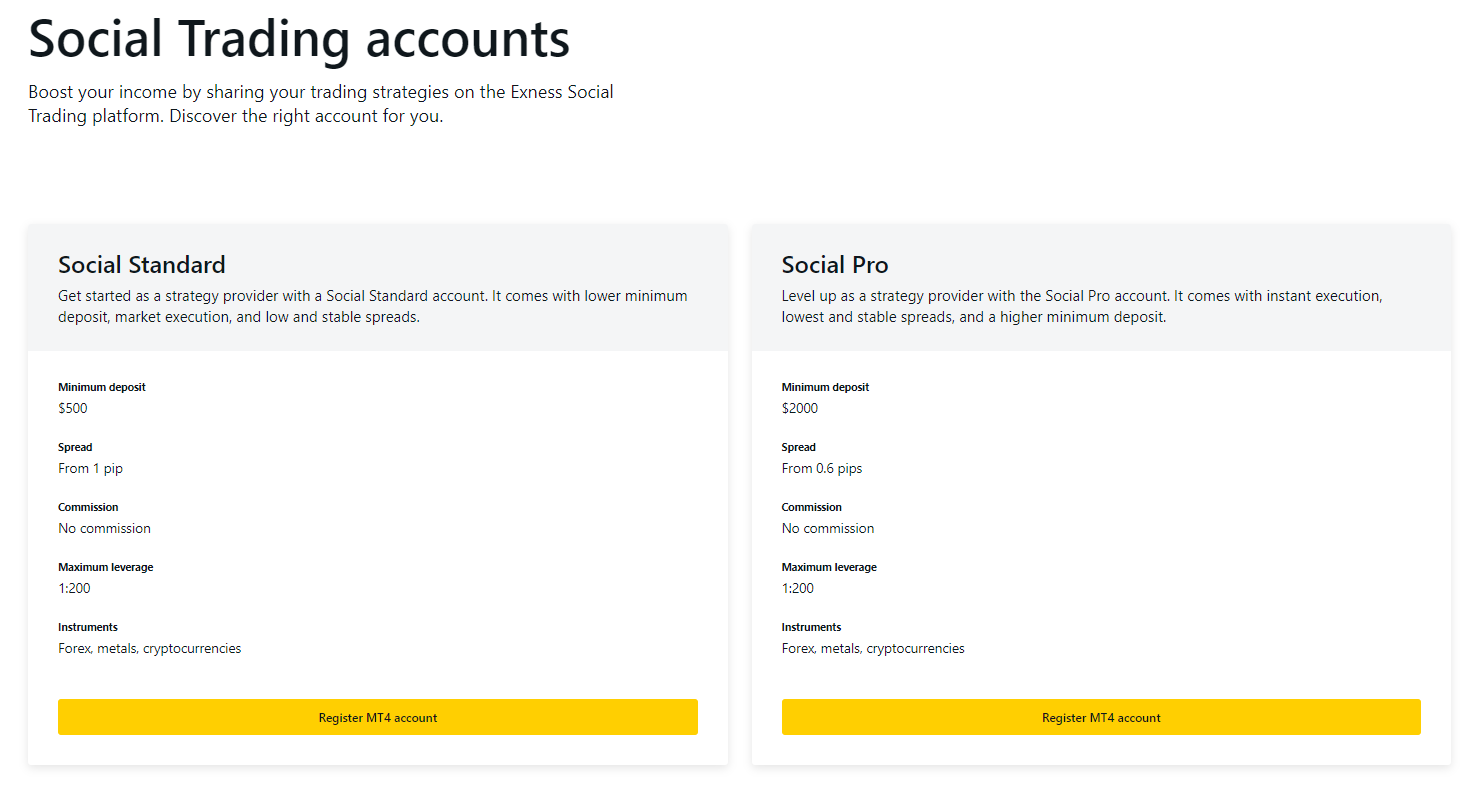

3. Social Trading Account:

Ideal For: Traders interested in sharing and copying trading strategies

Two Types: Social Standard and Social Pro

Minimum Deposit (Social Standard): $500

Minimum Deposit (Social Pro): $2000

Spreads (Social Standard): From 1 pip

Spreads (Social Pro): From 0.6 pips

Commissions: None

Leverage: Up to 1:200

Instruments: Forex, metals, cryptocurrencies

Execution: Market execution for social standard, instant execution for social pro (forex metals), and market execution for social pro (cryptocurrencies)

Additional Features: Strategy providers can earn commissions by allowing others to copy their trades.

Image source: Exness Social Trading Accounts

Exness' diverse range of trading accounts accommodates traders of varying experience levels and objectives. The Standard account offers a straightforward and versatile experience, while the Professional account provides advanced features and low spreads. For those interested in social trading, the Social accounts offer opportunities to share and copy strategies, fostering a collaborative environment.

Compliance and Regulation

Exness strongly emphasizes compliance and regulatory oversight to ensure a secure and trustworthy trading environment for its clients. The broker holds licenses from some of the most reputable financial authorities worldwide, including the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) in South Africa, and multiple other regulatory bodies in various jurisdictions. To find out more about their licenses, you can have a look at their website.

With a global presence and adherence to regulatory guidelines, Exness provides traders with the assurance that their investments are safeguarded and that the broker operates within the bounds of established regulatory frameworks. This commitment to compliance is a cornerstone of Exness' reputation as a reputable and responsible broker in the financial industry.

Payment Methods

Exness provides a variety of payment options, including bank wire transfers, credit/debit cards, and e-wallets like Skrill, Neteller, and WebMoney. Deposits are processed efficiently, ensuring quick access to accounts.

Exness Tools

Exness equips traders with a valuable toolbox, including analytical tools, an investment calculator, an economic calendar, a currency converter, tick history, VPS hosting, and access to Trading Central WebTV, facilitating informed decision-making and enhanced trading experiences.

Support Offered by Exness

Exness takes customer support seriously, offering multilingual assistance 24/7. Traders can easily reach out to their dedicated support team through live chat, email, or phone, ensuring prompt responses to queries or concerns. On the website, you can also find helpful shortcuts to frequently asked questions to aid you quicker. This commitment to accessibility and responsiveness enhances the overall experience and ensures traders have the assistance they need whenever they require it.

Image source: Exness Help Center

Email:

[email protected]

Telephone:

+35725008105

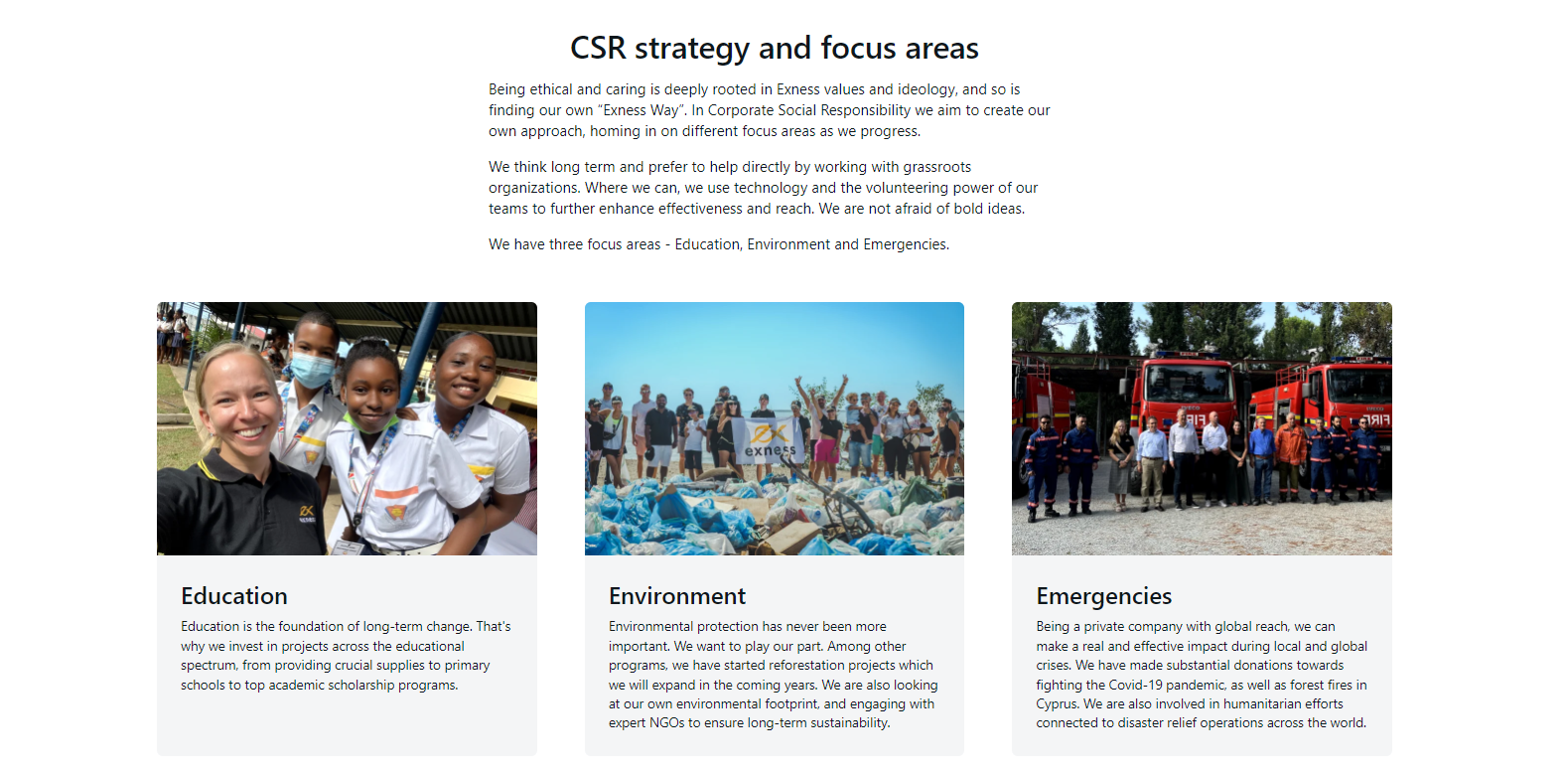

Exness Stands out from other forex brokers not only for its incredible offering for traders but also for its social responsibility to reach communities positively through education, outreach, and volunteering.

Image source: Education Social Responsibility Page

Exness Frequently Asked Questions

Is Exness a safe trader?

Yes, Exness is considered a safe broker. It is regulated by reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) in South Africa, and several other regulatory bodies. Exness places a strong emphasis on client safety and security, with segregated client funds and advanced encryption technology to protect client data and transactions.

Where is Exness located?

Exness is headquartered in Cyprus, and it also has offices in the UK, Australia, Israel, Seychelles, Singapore, Bulgaria, Estonia, the United States, Japan, and other locations.

What is the minimum deposit for Exness?

The minimum deposit requirement for Exness varies depending on the account type and payment system chosen. For example, the Standard account may not have a specific minimum deposit requirement, but it can vary based on the chosen payment method. The Pro account, designed for experienced traders, has a minimum deposit requirement of $200.

Is Exness safe for withdrawal?

Yes, Exness is safe for withdrawals. They prioritize the security of client funds and have established measures such as Negative Balance Protection and segregated client accounts in tier-1 banks to ensure the safety of client funds during both deposits and withdrawals.

Is Exness good for beginners?

Exness offers a range of account types, including the Standard account, which is suitable for traders of all levels, including beginners. It provides access to a wide range of trading instruments and offers features like stable spreads and market execution.