A TopBrokers360 AvaTrade Review for 2024

With its growing popularity among traders, striking a balance between innovation and accessibility, AvaTrade has been designed to cater to a wide range of traders, no matter their experience in the industry.

Let us take you on a journey into the broker’s noteworthy features, aiming to guide you through its service offerings, from its collection of trading assets to the intuitive nature of its platforms.

In the following AvaTrade review, we will also take a closer look at the key aspects such as its fee structure, trading tools, and educational support. Understanding these elements is crucial for anyone considering this broker as their trading partner. We aim to provide a thorough perspective, helping you make an informed decision about whether AvaTrade aligns with your trading goals and style.

Pros and Cons

Pros:

-

- User-Friendly Interface

- Wide Asset Range

- Strong Regulation

- Educational Resources

- Advanced Trading Tools

Cons:

- Restricted in Some Countries

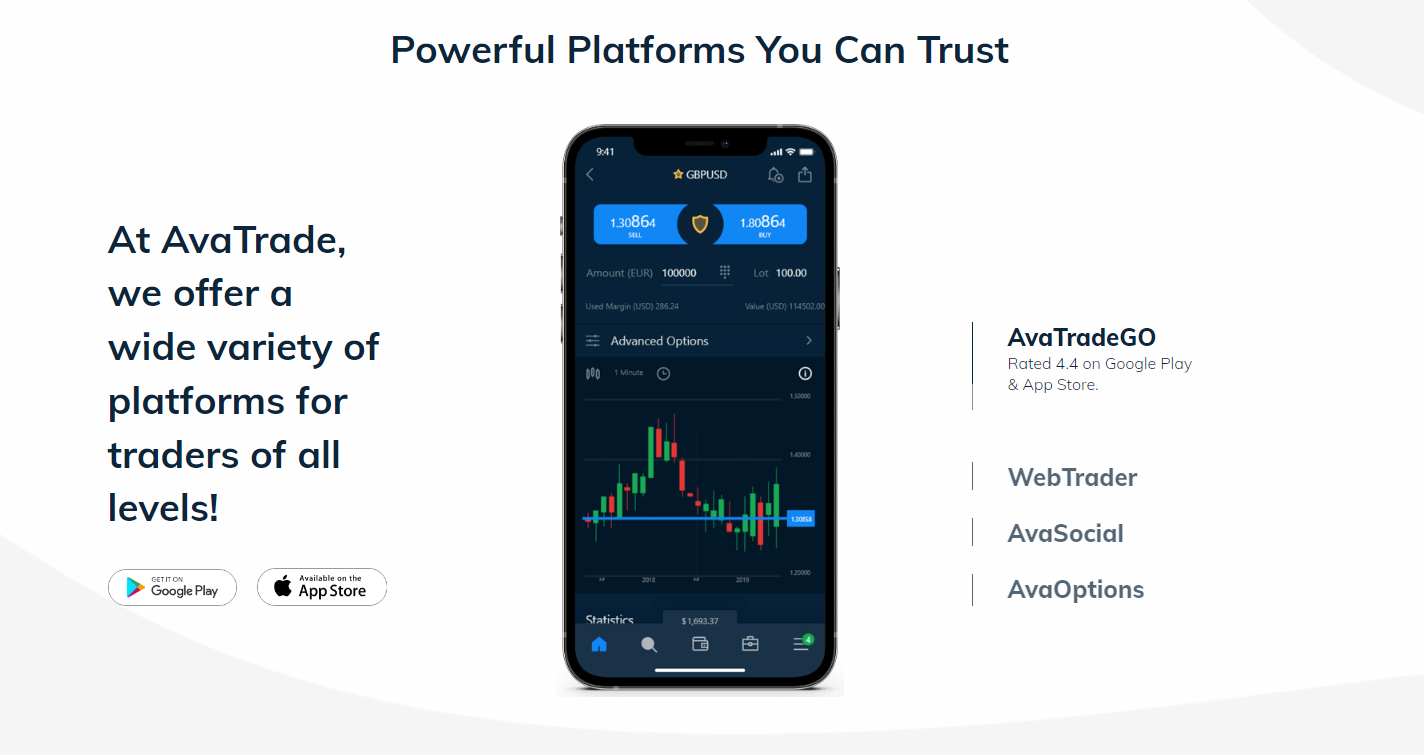

AvaTrade’s Trading Platforms

Image source: AvaTrade Homepage

When it comes to trading, the platform you use can make all the difference. Because of this, AvaTrade offers a range of trading platforms to cater to various trading preferences. Let's take a closer look at these platforms to help you find the perfect fit for your trading journey.

Web Trading Platforms

WebTrader

Starting with their award-winning proprietary platform, WebTrader is user-friendly and intuitive, requiring no downloads. It's a favorite among many AvaTrade traders for its simplicity and effectiveness.

Desktop Trading Platforms

MetaTrader 4

MetaTrader 4, or MT4, is a classic choice in the trading world. It offers a powerful and flexible trading environment suitable for both beginners and advanced traders. MT4 supports automated trading through Expert Advisors and various order types.

MetaTrader 5

The next-generation MetaTrader platform, MT5, provides state-of-the-art trading capabilities. It comes with advanced technical analysis tools, numerous order types, timeframes, and automated trading support with a new coding language.

AvaOptions

If you are interested in options trading, AvaOptions lets you express your market view with calls and puts. It provides embedded tools to enhance your Vanilla Options trading experience.

Mac Trading

Mac users aren't left out. Avatrade offers a version of MetaTrader 4 optimized for Mac, as well as access to WebTrader designed for Mac users.

Mobile Trading Platforms

AvaTradeGO

For those who want to trade on the go, AvaTradeGO is the mobile app you need. It features a user-friendly interface, advanced trading features, and charts optimized for smartphone screens.

AvaSocial

Social trading enthusiasts will appreciate AvaSocial. This innovative mobile app allows you to follow and copy expert traders, interact with mentors or groups, and discover new trading strategies.

- Over 1,250 CFDs Available

- Advanced Technical Analysis Tools

- Automated Trading Support

- User-friendly Mobile App

- Social Trading Integration

- Forex, Stocks, Indices, Commodities

- Multiple Order Types

- MetaTrader 4 and 5 Platforms

- Proprietary WebTrader Platform

- Customizable Charts and Indicators

AvaTrade’s Assets

➟ Learn more about AvaTrade’s offerings

AvaTrade provides a broad spectrum of over 1,250 CFDs, allowing traders to diversify their portfolios across various markets. Here's a snapshot of the products they offer:

Instruments:

Forex:

- Avatrade provides access to over 50 major, minor, and exotic currency pairs for forex trading. This includes popular pairs like EUR/USD, GBP/USD, and USD/JPY.

Cryptocurrencies:

- Traders can trade popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Ripple, and more. Avatrade allows trading cryptocurrencies as CFDs (Contracts for Difference).

Indices:

- Avatrade offers trading on major market indices from exchanges globally. This includes options like FTSE 100, NASDAQ 100, Nikkei 225, and more.

Stocks:

- Traders can trade CFDs on over 200 top stocks from exchanges around the world. This includes popular stocks like Apple, Amazon, Tesla, and more.

Commodities:

- Avatrade provides CFD trading access to several commodities, including agriculture (cocoa, coffee, corn), energies (crude oil, natural gas), and metals (gold, silver, platinum).

ETFs:

- Traders can gain diversified exposure to markets through ETF CFDs (Exchange-Traded Funds) tracking various assets.

Comparing the Trading Accounts

➟ CTA Find the perfect account suited to your personal preferences and experience levels!

Retail Account: This account is suitable for day traders and offers competitive spreads and a wide choice of assets. It is designed for individual traders who want to trade on the AvaTrade platforms.

Professional Account: The Professional Account is designed for experienced traders who meet certain criteria. It offers high leverage, low spreads, and additional features such as hedging and scalping. Traders need to meet specific requirements to qualify for this account.

Islamic Account: AvaTrade offers an Islamic Account that is compliant with Shariah law for Muslim traders. This account is swap-free, meaning there are no overnight interest charges on positions held overnight.

MAM Account: The MAM (Multi-Account Manager) Account is designed for money managers who manage multiple trading accounts. It allows money managers to execute trades on behalf of their clients and allocate trades proportionally.

Each account type has its own features and benefits, catering to different trading styles and preferences. Traders can choose the account type that best suits their needs and trading strategies.

Image source: AvaTrade Trading Accounts

Compliance & Regulation - Is AvaTrade Legit?

➟ AvaTrade’s Licenses and Regulations

AvaTrade is subject to comprehensive global regulation, ensuring its compliance with high financial standards. Key regulators include the Financial Futures Association of Japan (FFAJ) and the Financial Services Agency in Japan, Cyprus Securities and Exchange Commission (CySEC), Israel Securities Authority (ISA), and Canada's Investment Industry Regulatory Organization (IIROC - Friedberg Direct). In the Middle East, it's regulated by the Abu Dhabi Global Markets Financial Services Regulatory Authority (ADGM / FSRA). European oversight is provided by the Central Bank of Ireland (CBI), and in the British Virgin Islands, it's regulated by the Financial Services Commission (BVIFSC). The AvaTrade broker is also governed by South Africa’s Financial Sector Conduct Authority (FSCA) and the Australian Securities and Investments Commission (ASIC), ensuring a broad regulatory compliance spectrum.

What are AvaTrade’s Payment Methods?

AvaTrade offers a range of payment methods to suit various client needs. Deposits can be made using credit and debit cards, which are generally credited instantly, although first-time deposits might take up to a business day due to security verification. E-payments like Neteller, Skrill, and WebMoney are credited within 24 hours. Wire transfers may take up to 7 business days, depending on the banking institution and country. The minimum deposit amount varies depending on the account's base currency and deposit method, typically starting at around $100 or equivalent. AvaTrade recommends a starting balance of 1,000-2,000 of your preferred base currency for full access to its products.

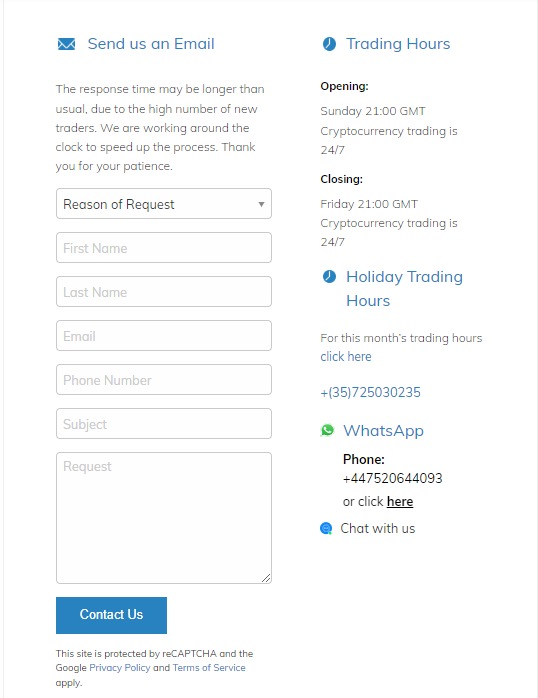

Support Offered by AvaTrade

AvaTrade offers various channels for customer support, including phone, email, and chat. Their support team is available 24 hours a day, 5 days a week, and can assist with account opening, customer support, and affiliate program inquiries. They provide support in multiple languages and strive to respond to customer inquiries in a timely manner. Additionally, AvaTrade offers a comprehensive Education and Trading Info on their website, where users can find answers to common questions and access additional support resources. It is important to note that the response time for customer support may be longer than usual due to a high number of new traders.

For specific contact details and phone numbers for different regions, it is recommended to visit the AvaTrade Contact Us page on their official website.

Image source: AvaTrade Contact us Page

Address:

Dockline, Mayor Street, Dublin 1, D01 K8N7, Ireland

Telephone:

+447520644093

Is AvaTrade a Good Platform for Your Trading Needs?

In our AvaTrade review, we have found that this broker excels in providing a secure, diverse, and user-friendly trading environment. It effectively caters to various traders' needs, from beginners seeking educational resources to experienced traders looking for advanced tools. While it maintains strong regulatory compliance and offers a wide range of trading instruments, it also upholds a balance of accessibility and sophistication. This makes AvaTrade a solid choice for anyone venturing into the dynamic world of online trading.

Frequently Asked Questions

Yes, AvaTrade is a trusted broker, regulated by multiple top-tier authorities globally.Is my money safe in AvaTrade?

Your funds are safe with AvaTrade, thanks to their adherence to stringent regulatory standards and segregated client accounts.Is AvaTrade a good platform for beginners?

Yes, AvaTrade is beginner-friendly, offering educational resources and user-friendly trading platforms.How much is the minimum deposit for AvaTrade?

The minimum deposit at AvaTrade typically starts at around $100.Which country is AvaTrade based in?

AvaTrade is headquartered in Ireland and operates globally under various regional regulations.What are the best trading platforms offered by AvaTrade?

AvaTrade offers a variety of platforms including MetaTrader 4, MetaTrader 5, and their proprietary WebTrader and AvaTradeGO.

How do AvaTrade's spreads compare?

AvaTrade's spreads are competitive and market-responsive. They offer tight spreads on major forex pairs, enhancing trading efficiency for forex-focused traders. Spreads on other instruments like CFDs and commodities adjust according to market conditions, reflecting AvaTrade's commitment to cost-effective trading for its clients.

What are AvaTrade’s leverage offerings?

AvaTrade provides varying leverage options across different trading instruments. For Forex trading, leverage can go up to 30:1, depending on the jurisdiction and currency pair. In CFD trading, the same maximum leverage applies, but it may differ for each instrument. ETF traders have the opportunity to trade with leverage up to 5:1. Similarly, individual equities can be traded on margin, allowing for leveraged positions, with the specific ratio varying. Avatrade’s leverage options demonstrate flexibility in accommodating different trading strategies and risk preferences.

Can I open an AvaTrade demo account?

Yes, AvaTrade offers a free demo account for practice trading.

How do I manage my AvaTrade Login for secure access?

To access your AvaTrade account, navigate to the AvaTrade login section in the top right of the screen. Enter your credentials securely to manage your trading activities. It's a straightforward process designed for ease of use, ensuring quick access to your account and trading platforms.