Understanding Leveraged Trading:Risks and Opportunities

Leveraged trading is a powerful tool that allows traders to control larger positions with a relatively small investment. While it can amplify profits, it equally increases the potential for losses. To navigate leveraged trading successfully, understanding its risks and opportunities is essential. In this article, we will explore what leverage is, how it works in trading, the associated risks, and the potential opportunities.

What is Leverage in Trading?

Leverage in trading refers to borrowing capital from a broker to increase the size of a position beyond what you could afford with your available funds. Essentially, it’s a ratio between the amount of capital you contribute and the amount the broker lends.

Opportunities in Leveraged Trading

The primary appeal of leveraged trading is the opportunity for higher returns with a smaller initial investment. This is particularly valuable in markets like forex trading, where small price movements can translate into significant gains when leverage is applied.

- Access to Larger Positions: Leverage enables traders to control bigger trades than their capital would typically allow. This allows individuals with limited funds to participate in significant market opportunities.

- Amplifying Profits: When used correctly, leverage can magnify returns. For example, a 1% price increase on a leveraged position can result in a 10% return if you’re using 10:1 leverage.

- Diversification: Traders can use leverage to diversify their investments across multiple assets, maximizing CFD and forex opportunities without tying up all their capital.

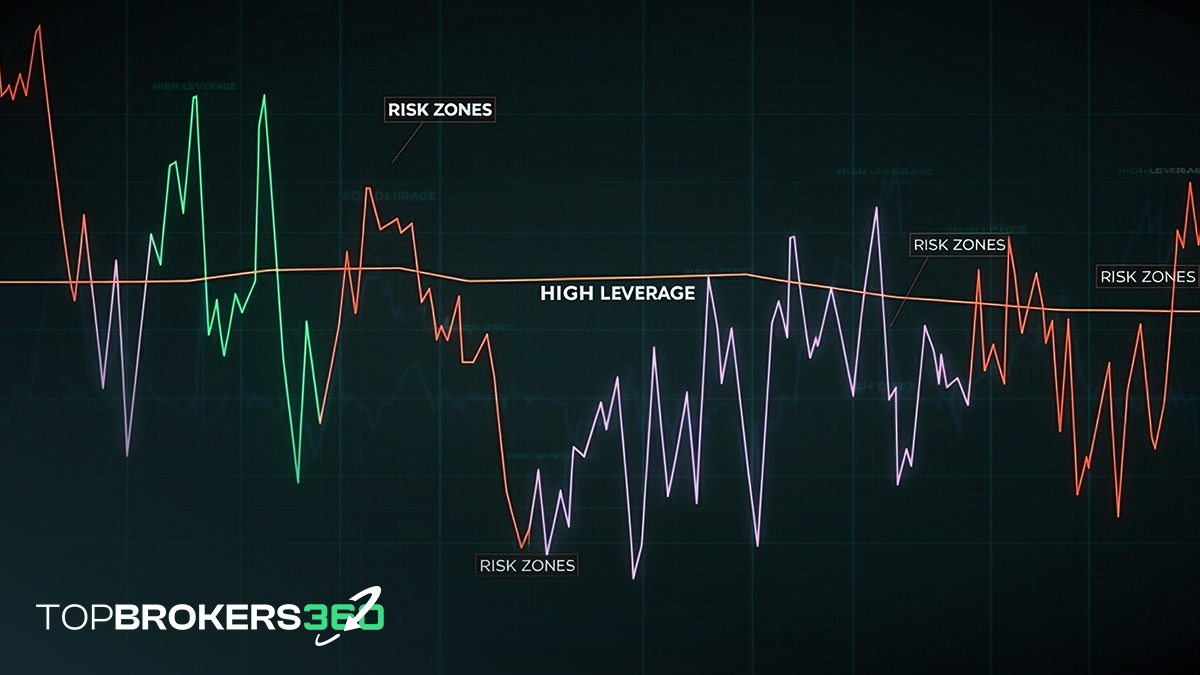

Trading Risks: The Other Side of Leverage

While the potential for high returns is exciting, leveraged trading also carries substantial risks. The same leverage that amplifies profits can magnify losses. Traders need to be fully aware of the following risks:

- Increased Losses: If a trade moves against you, losses are magnified just as much as gains. With high leverage, even minor market fluctuations can trigger significant losses.

- Margin Calls: Brokers require traders to maintain a minimum balance, known as margin. If your trade goes against you and the margin falls below a certain threshold, you’ll face a margin call, requiring you to deposit additional funds or risk having your position closed.

- Market Volatility: Highly leveraged trades are more vulnerable to sudden price swings, especially in volatile markets like forex or commodities.

How to Manage Trading Risks in Leveraged Trading

To harness the opportunities of leveraged trading while mitigating risks, consider these strategies:

- Start Small: Use lower leverage ratios initially to minimize potential losses. Brokers often allow leverage ranging from 5:1 to 100:1, but beginners should stick to conservative ratios.

- Use Stop-Loss Orders: Stop-loss orders automatically close your position if the price moves against you, limiting your losses.

- Understand Margin Requirements: Always be aware of how much margin is required and ensure you have enough capital to avoid margin calls.

- Stay Updated on the Market: Regularly analyze market trends and news to make informed decisions. Markets can react quickly to economic or geopolitical events.

![Panoramica Economica Settimanale [05.07.24]: S&P 500, NASDAQ, Tesla e Apple](https://www.topbrokers360.com/wp-content/uploads/2024/07/Weekly_Update_Thumbnail_5.jpg)

![Panoramica Economica Settimanale [28.06.24]: Tendenze del Mercato Azionario USA, Approfondimenti sull’Inflazione e Analisi di NVIDIA](https://www.topbrokers360.com/wp-content/uploads/2024/06/Weekly_Update_Thumbnail_4.jpg)