A TopBrokers360 XTB Review for 2024

With over two decades of experience, XTB distinguishes itself as a leading European FX & CFD brokerage group, underlined by its status as one of the largest stock exchange-listed FX & CFD brokers in the world. Operating with a foundational commitment to transparency, XTB regularly discloses its earnings and cash reserves, reassuring traders of its financial stability. Offices spread across over 13 countries, including the UK, Poland, Germany, France, and Chile, underscore its global footprint and local expertise.

XTB's dedication to leveraging cutting-edge technology delivers award-winning trading solutions designed to meet diverse trading goals. The brokerage serves an impressive client base of over 847,000 customers worldwide, backed by stringent regulation from major authorities like the FCA, KNF, CySEC, and FSC. This blend of regulatory compliance, advanced technology, and a focus on customer service, along with an extensive library of educational resources, positions XTB as a broker committed to enhancing trader success in Forex, indices, commodities, stocks, ETFs, and cryptocurrencies markets.

➟ Our TopBrokers360 Reviews aim to help you make smarter trading choices.

Pros and Cons

Pros:

- Globally Regulated

- xStation 5 Platform

- Educational Resources

- Zero Commissions (UK)

- Diverse Market Access

Cons:

-

- Limited Third-Party Tools

- Withdrawal Fees

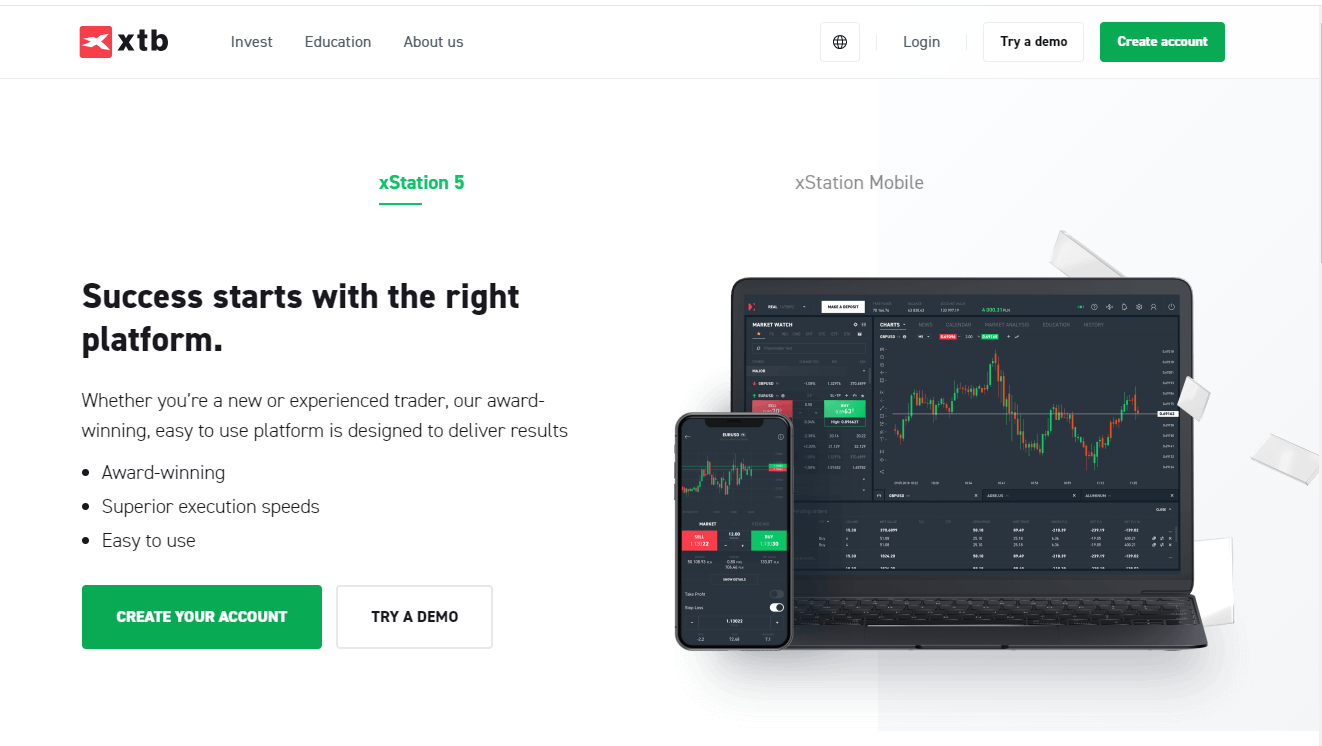

The XTB Trading Platforms

XTB offers a powerful and versatile trading platform known as xStation 5. This proprietary platform combines user-friendly simplicity with advanced functionality, making it suitable for both novice and experienced traders. xStation 5 boasts an intuitive interface that facilitates easy navigation and efficient trade execution. Traders can access real-time market analysis, interactive charts, and a wide range of trading tools to support their decision-making processes.

One of the platform's key strengths is its versatility. It's available on various devices, including web browsers, iOS, Android, and desktop applications, providing traders with the flexibility to engage with the markets anytime, anywhere. xStation 5 consistently receives updates to incorporate the latest trends and features, aligning with XTB's commitment to delivering a superior trading experience. This dedication has earned xStation 5 recognition, including awards such as "Best Forex Broker Proprietary Platform" and "Best Mobile Trading App," for the XTB app, highlighting its user-friendly design and execution speed. With access to over 5,600 instruments, including CFDs for FX, cryptocurrencies, indices, commodities, stocks, and ETFs, xStation 5 is an all-inclusive platform for traders of all levels.

Image source: XTB’s xStation 5 Trading Platform

- Real-time Market Insights

- Customizable Interactive Charts

- Intuitive User Interface

- Cross-platform Accessibility

- Advanced Trading Tools

- One-click Trade Execution

- Personalized Dashboard Setup

- Integrated Economic Calendar

- Effective Risk Management

- Easy Account Management

XTB Trading Assets

XTB offers an impressive range of products and services, ensuring traders can access a wide variety of markets all under one roof. From the dynamic world of Forex to the vast expanse of commodities, indices, and beyond, XTB caters to every trader's needs. The broker's focus on providing a comprehensive trading environment is evident in its selection of CFD instruments, allowing traders to speculate on price movements without owning the underlying assets. If you are looking to diversify your portfolio or specialize in specific markets, XTB's offering is designed to enhance your trading journey with flexibility and opportunity.

Instruments:

Forex: Trade over 50 currency pairs including majors like EUR/USD, minor pairs such as EUR/GBP, and exotic pairs like USD/PLN. XTB provides low spreads and high leverage options.

Indices: Access more than 20 of the world's leading indices including the S&P 500, DAX, and FTSE 100.

Commodities: Trade a variety of commodities CFDs including gold, silver, oil, natural gas, and a range of agricultural products like coffee and sugar.

Cash Stocks: Invest in the shares of leading companies across the US, UK, and European markets.

ETFs: Explore a diverse range of Exchange-Traded Funds (ETFs), offering exposure to various sectors, commodities, or indices in a single trade.

Cryptocurrencies: Engage with the fast-paced world of cryptocurrencies by trading CFDs on Bitcoin, Ethereum, Ripple, and more.

Investment Plans: For those looking for a more hands-off approach, XTB's investment plans offer automated strategies based on your risk profile. This innovative service allows traders to invest in a diversified portfolio of assets, managed by XTB's expert team.

XTB Trading Accounts Review

➟ Find Out More About the XTB Trading Accounts in Different Countries

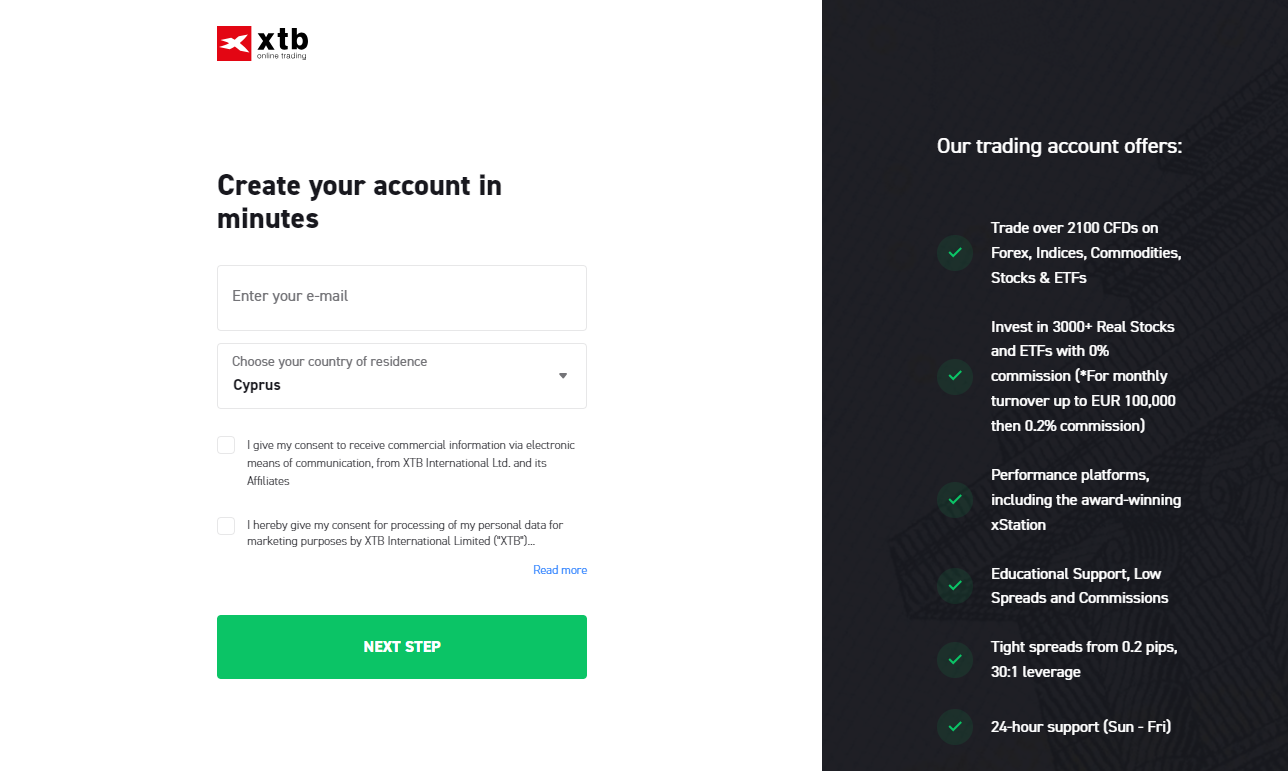

The broker primarily offers a Standard Account suitable for traders of all levels. It is a versatile choice that doesn't charge commissions (except for Equity CFDs and ETFs) but factors most of the trade costs into the spread. For traders outside of Europe, XTB extends the option of a Swap-free/Islamic Account, ensuring compliance with Islamic law by eliminating swap fees.

Opening an account with XTB is a breeze, with a fully digital and efficient process. In just about 30 minutes, you can complete the necessary forms and document submissions. The broker is committed to fast verification, often within a day.

Image source: XTB Account Sign up

Is XTB Legit & Regulated?

➟ Have Peace of Mind With XTB's Regulatory Compliance

When it comes to trust in trading, our XTB review found that the broker takes it seriously. The company operates under the watchful eyes of respected financial authorities worldwide, including the UK's Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Polish Financial Supervision Authority (KNF), National Securities Market Commission (CNMV) of Spain, Dubai Financial Services Authority (DFSA), and International Financial Services Commission of Belize (IFSC). This means XTB adheres to stringent rules, ensuring transparency and safeguarding your interests.

Being a publicly listed company on a stock exchange shows XTB's commitment to transparency and ethical conduct. They also provide negative balance protection for added safety. In short, XTB's regulatory compliance means you can trust them to keep your trading secure and reliable.

XTB's Diverse Payment Methods

When it comes to managing your funds with XTB, you will find a user-friendly approach. The broker offers multiple payment methods, including bank transfers, credit and debit cards, and e-wallets like PayPal and Skrill.

Here's the good part: Traders are not charged for account opening or maintenance, regardless of the account balance. Deposits are typically free, but do keep in mind that some methods might have fees from payment providers. The best part? There's no minimum deposit requirement, making XTB accessible for traders of all levels.

When you are ready to withdraw your funds, XTB ensures that withdrawals above 50 USD won't cost you a dime. However, it is essential to note that fees from your bank may apply when using payment cards, bank transfers, or online payments. While the broker doesn't charge extra for currency conversion, your bank might if you fund your account from a different currency.

Support from Your Trading Partner

In our XTB broker review, we found that the support team is always ready to assist you on your trading journey, ensuring you have the information and guidance you need.

For inquiries related to account opening or general assistance, reaching out to XTB's support team via email is a convenient option. If you require immediate assistance, their phone support is just a call away. The brokerage is known for its quick response times, ensuring that your questions and concerns are addressed promptly.

With customer service available 24/5 for European clients and a responsive live chat feature, XTB provides dependable support. It is worth noting that XTB was recognized with the "Best Customer Service 2021" award, highlighting their commitment to excellent support.

[email protected]

+357 257 25356

Final Thoughts on Our XTB Review for 2024

XTB, with over two decades of experience, stands out as a premier European FX & CFD brokerage group. This stock exchange-listed giant prides itself on transparency, revealing earnings and cash reserves to assure traders of its financial stability. With a global presence spanning over 13 countries, XTB combines local expertise with cutting-edge technology. It serves a vast client base, backed by stringent regulation from authorities like the FCA, KNF, CySEC, and FSC. Offering diverse assets and a proprietary platform, XTB empowers traders of all levels with comprehensive education, making it a formidable partner in the world of Forex, indices, commodities, stocks, ETFs, and cryptocurrencies.

Frequently Asked Questions

Is XTB a good broker?

Yes, XTB is a reputable broker with over 20 years of experience and strong regulation from authorities like the FCA and CySEC. It offers a user-friendly platform, diverse assets, and excellent customer support.

Is XTB good for beginners?

XTB caters to traders of all levels, making it suitable for beginners. It offers educational resources, an intuitive platform, and a Standard Account with no commissions (except for Equity CFDs and ETFs).

Is XTB regulated?

XTB is regulated by major authorities worldwide, including the FCA in the UK, CySEC in Cyprus, and KNF in Poland. Its commitment to regulatory compliance ensures transparency and security.

Is XTB safe?

Yes, XTB is considered safe due to its strict regulation, negative balance protection, and commitment to transparent and ethical conduct.

What are the fees associated with trading at XTB?

XTB is known for its transparency. While it doesn't charge commissions on the Standard Account (except for Equity CFDs and ETFs), it factors most trade costs into the spread. Some deposit methods may involve additional fees charged by payment providers, but XTB does not charge any fees for account opening or maintenance.

Is there a minimum deposit requirement at XTB?

No, XTB does not have a minimum deposit requirement, making it accessible for traders of all levels.

How can I withdraw funds from my XTB account, and are there withdrawal fees?

Withdrawals above 50 USD at XTB are free of charge. However, it's important to note that fees from your bank may apply when using payment cards, bank transfers, or online payments. XTB does not charge additional currency conversion fees, but your bank might impose such fees if you fund your account in a different currency.

Is XTB suitable for day trading or long-term investing?

XTB caters to both day traders and long-term investors. Its platform and tools are designed to accommodate various trading styles, and its diverse asset selection, including CFDs for Forex, cryptocurrencies, indices, commodities, stocks, and ETFs, allows traders to pursue both short-term and long-term strategies.