A TopBrokers360 BlackBull Markets Review for 2024

BlackBull Markets, an award-winning brokerage founded in 2014, has quickly gained prominence as an ECN Broker based in New Zealand. This innovative company is at the forefront of the online trading industry, pioneering new possibilities for traders.

BlackBull Markets boasts a remarkable range of over 26,000 tradable instruments, encompassing stocks, forex, CFDs, and commodities. With a relentless commitment to reshaping the financial industry, BlackBull Markets operates under the supervision of esteemed regulatory bodies worldwide. Notably, the Financial Markets Authority (FMA) in New Zealand and the Financial Services Authority (FSA) of Seychelles closely oversee the operations of this pioneering brokerage firm.

Pros and Cons

Pros:

- Decent FX and CFD fees

- Minimum Deposit: $0

- Leverage of Up to 1:500

- New Zealand Residents can Access this Service

- Over 26,000+ Tradeable Symbols

- More Than One Third-Party Copy Trading Platform is Available

Cons:

- Operates Under a Single Tier-1 Regulatory License

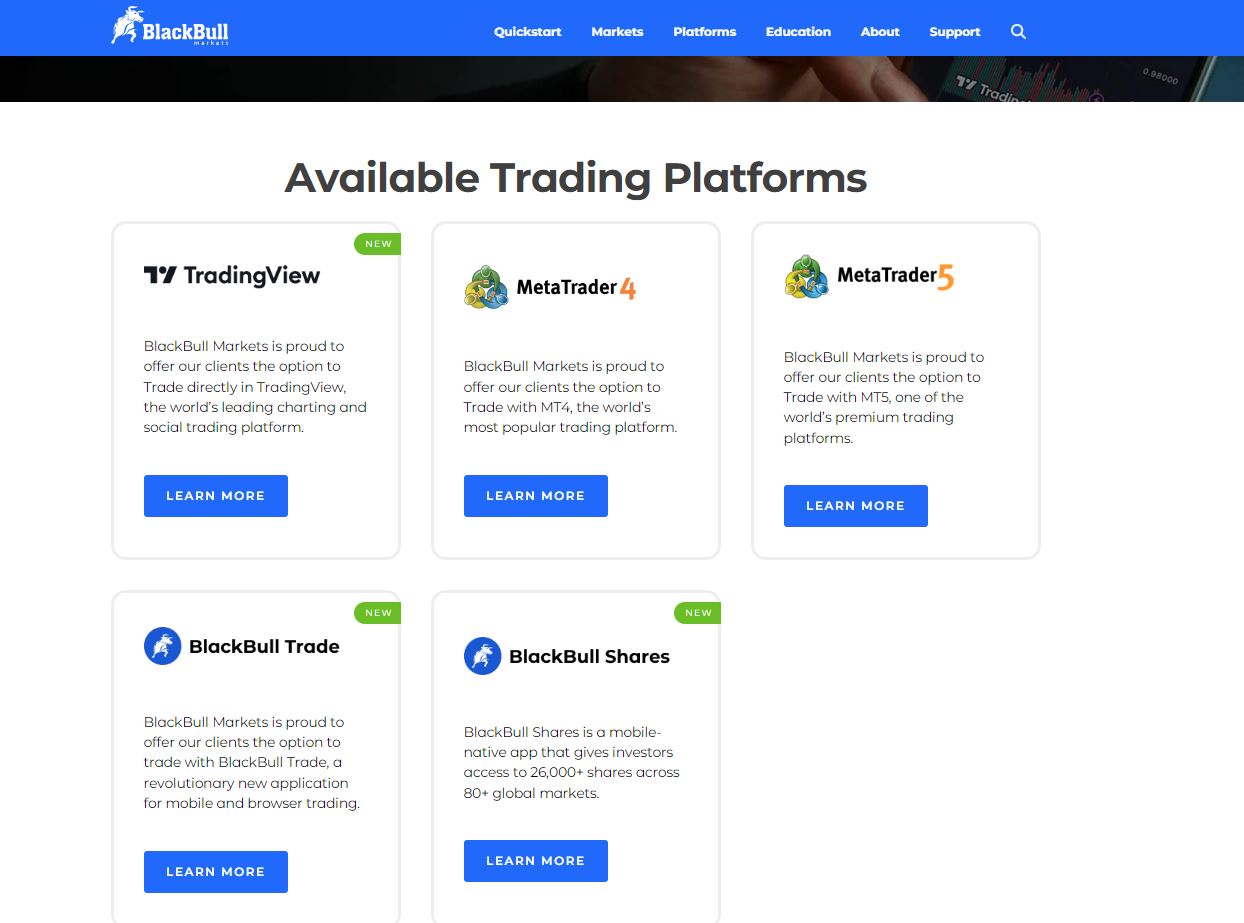

Trading Platforms Tailored for User Convenience

Image source: BlackBull Markets Trading Platform

BlackBull Markets offers traders a range of state-of-the-art trading platforms designed to meet their specific requirements. One notable option is MetaTrader 5, a highly regarded multi-asset platform favored by traders and investors worldwide. Additionally, BlackBull Markets provides seamless access to the renowned MetaTrader 4 platform, offering rapid and responsive infrastructure, advanced charting analysis, automated trading capabilities, and more.

For clients who value community features, robust charts, and analytical tools, BlackBull Markets supports account integration with TradingView's platform. Alternatively, for those interested in purchasing individual company stocks and becoming shareholders to reap the benefits of their growth, the BlackBull Share Trading Platform is an excellent choice. With diverse platform options, BlackBull Markets caters to a range of trading preferences.

- Copy Trading

- ZuluTrade

- VPS Trading

- FIX API Trading

- Autochartist for MT4 and MT5

- Myfxbook

Limitless Trading Possibilities

With the introduction of BlackBull Shares, BlackBull Markets has significantly expanded its market offerings, providing traders with access to a vast selection of over 26,000 tradable instruments. This diverse range includes 70 currency pairs, major market indices, valuable precious metals like gold and silver, and sought-after commodities such as gas and oil. For those interested in the exciting world of cryptocurrencies, BlackBull Markets offers cryptocurrency trading through CFDs, allowing traders to participate in the dynamic crypto market.

Moreover, sought-after stocks such as Tesla, Apple, and Amazon are available for trading through CFDs at BlackBull Markets. Traders also have access to a wide range of indices, including the NASDAQ 100, S&P 500, the Dow Jones Industrial Average, and numerous others. These offerings ensure a diverse range of trading opportunities for clients, allowing them to explore and capitalize on various market sectors within the BlackBull Markets platform.

Instruments

Shares:

- Engage in trading popular share CFDs, such as Tesla, Apple, and Amazon

Indices:

- BlackBull Markets offers a comprehensive selection of major indices for trading, encompassing renowned options like the NASDAQ 100, S&P 500, the Dow Jones Industrial Average, and more.

Crypto:

- Experience the advantages of 1:5 leverage, rapid execution, and competitive spreads when trading 11 prominent cryptocurrencies at BlackBull Markets.

Commodities:

- Diversify your portfolio by trading essential global assets like gold, oil, and silver through Commodity CFD trading, tapping into market volatility and gaining exposure to valuable raw materials.

Forex:

- BlackBull Markets provides retail forex traders with cost-effective trading options, featuring leverage of up to 500:1, ultra-low spreads starting from 0.0 pips, and swift execution with an average speed of under 20ms.

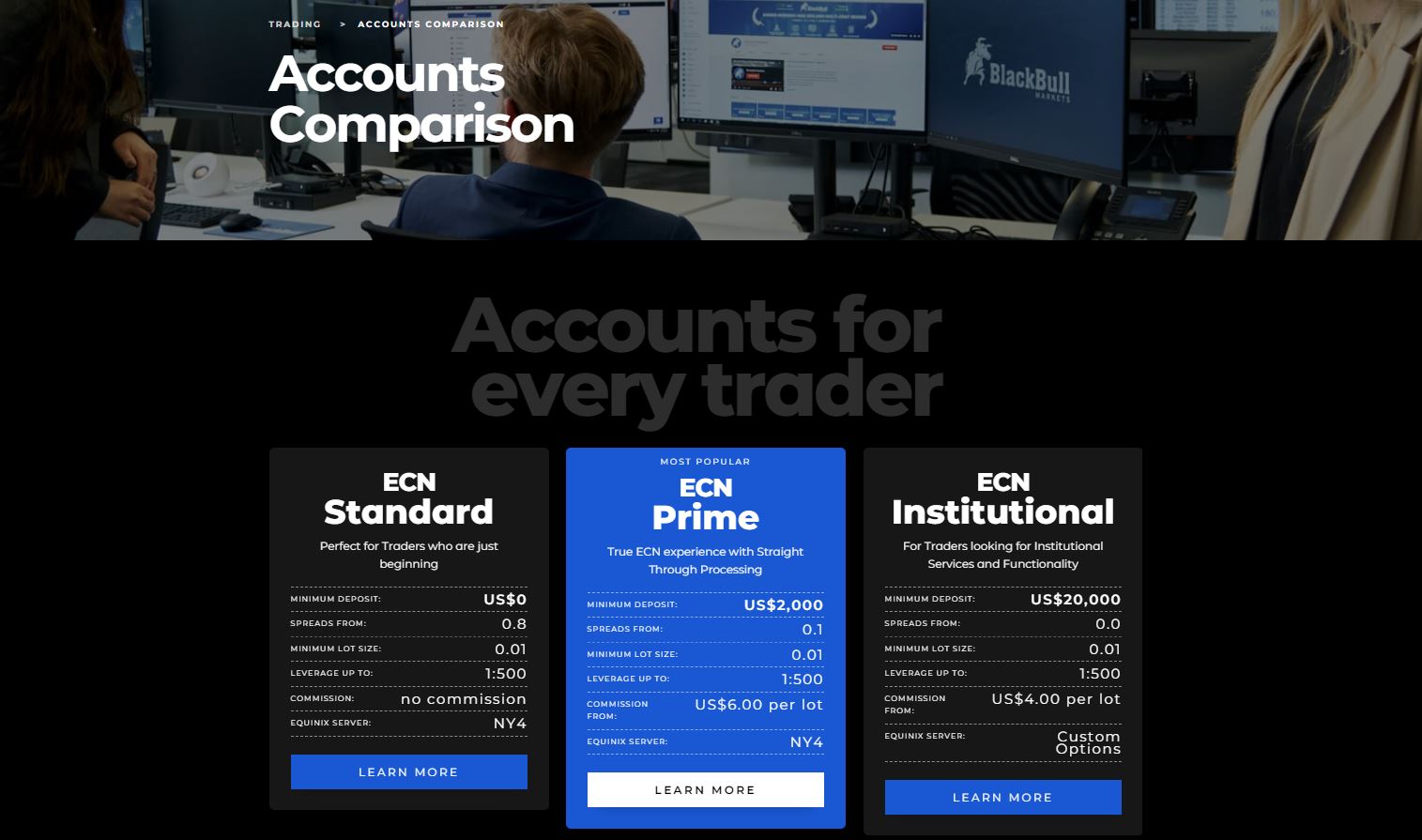

Explore the Wide Range of Account Choices Available at BlackBull Markets!

Customize Your Trading Journey with a Variety of 3 Account Types

The Standard account at BlackBull Markets provides a commission-free trading experience without any mandatory minimum deposit. For traders seeking lower spreads, the ECN Prime account offers an attractive option, albeit with a minimum deposit requirement of $2,000 and a commission of $3 per side or $6 round turn per lot. As for the ECN Institutional account, it is designed for elite active traders who deposit a minimum of $20,000. Commission rates for this exclusive account type are negotiated on an individual basis with the broker, ensuring personalized terms that align with the trader's specific needs. All account types at BlackBull Markets provide access to leverage of up to 1:500, offering traders the potential to amplify their trading power.

Image source: BlackBull Markets Trading Accounts

Devoted to Ensuring Regulatory Compliance

BlackBull Markets is a trusted and reputable broker with a strong commitment to regulatory compliance. The company holds licenses from prominent financial regulators, such as the Financial Markets Authority (FMA) in New Zealand, among others.

BBG Limited (trading name: BlackBull Markets) is a limited liability company incorporated and registered under the laws of Seychelles, with company number 857010-1. The Company is authorized and regulated by the Financial Services Authority in Seychelles (“FSA”) under license number SD045 for the provision of investment services.

Black Bull Trade Limited is a New Zealand limited liability company incorporated and registered under the laws of New Zealand, with NZBN 9429049891041 and registered address Floor 20, 188 Quay Street, Auckland Central, Auckland 1010, New Zealand. Black Bull Trade is registered FSP1002113.

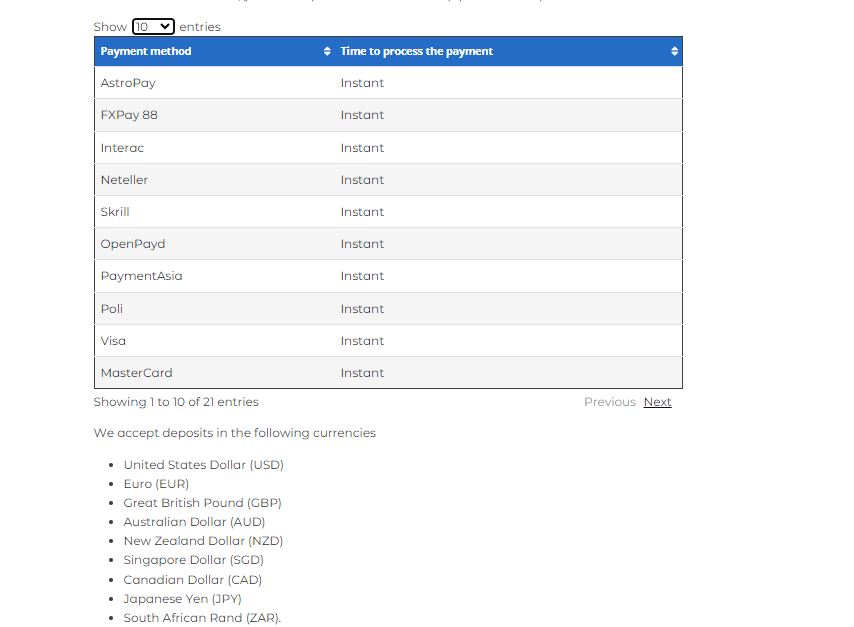

Flexible Payment Solutions for Your Ease and Convenience

Image source: BlackBull Markets Funding Methods

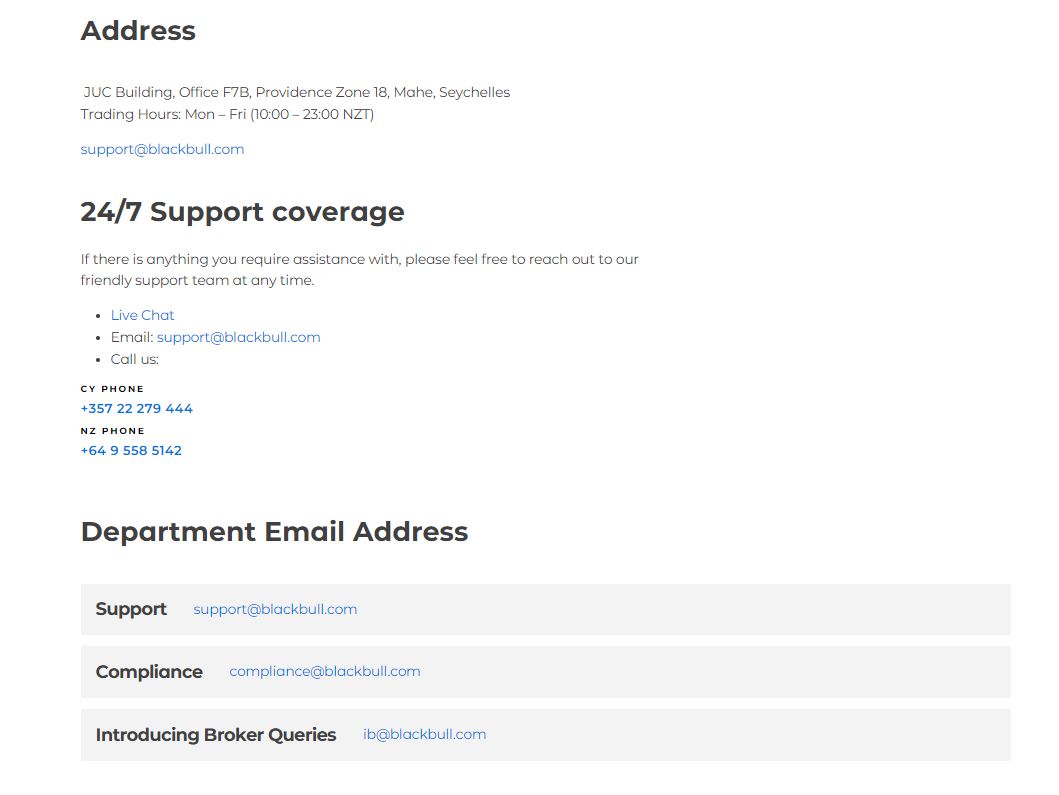

Engage with BlackBull Market's Committed Support Team for Assistance

BlackBull Markets is dedicated to delivering exceptional customer service to its users through its client support center. Manned by a team of highly skilled professionals, the support team is readily available to assist traders with any inquiries or concerns they may have.

If you prefer a callback or an online chat, BlackBull Markets offers comprehensive support options to cater to your preferences. Moreover, the broker provides an advanced and innovative help page that offers all the essential contact details for clients, ensuring easy access to the necessary assistance.

Image source: BlackBull Markets Contact Us page

BlackBull Markets has been honored with multiple awards for its exceptional service and commitment to the trading community, including recognition as Best in Class for Offering of Investments in the 2023 Annual Awards by ForexBrokers.com.

Image source: BlackBull Markets Trading Awards

Is BlackBull Markets a Good Broker?

Based on the extensive review provided by TopBrokers360 for 2024, BlackBull Markets emerges as a commendable broker when it comes to online trading. Established in 2014 and operating as an ECN Broker out of New Zealand, it has rapidly gained a reputation for its extensive range of trading instruments, encompassing over 26,000 options including forex, stocks, CFDs, and commodities. The broker's dedication to regulatory compliance, underscored by its licensure with reputable authorities like the FMA in New Zealand and the FSA in Seychelles, reinforces its legitimacy and adherence to high operational standards.

BlackBull Markets offers a competitive edge with its affordable fee structure, diverse account types suited to different trading styles and requirements, and a selection of advanced trading platforms like MetaTrader 4 and 5, and TradingView integration. This versatility ensures that both novice and experienced traders find suitable tools and resources to enhance their trading experiences.

While it operates under a single tier-1 regulatory license, BlackBull Markets compensates with an array of trading tools, broad educational materials, and a commitment to excellent customer service. These features, combined with its accolades for service excellence and investment offerings, firmly position BlackBull Markets as a reliable and proficient choice for traders seeking a robust and versatile trading environment.

Frequently Asked Questions

Who is the owner of BlackBull Markets?

BlackBull Markets was founded by Michael Walker and Selwyn Loekman in 2014 in Auckland, New Zealand.

How much does BlackBull Market charge?

The fees and commissions at BlackBull Markets vary depending on the account type and trading activity. Detailed information on their fee structure can be found on their website.

Where are the BlackBull servers located?

The specific locations of BlackBull Markets' servers are not publicly disclosed. For detailed information, it's best to contact them directly.

Is BlackBull Market legit and regulated?

Yes, BlackBull Markets is a legitimate, broker, regulated by multiple financial authorities. Alongside the Financial Services Authority (FSA) in Seychelles, they are also regulated by other international regulatory bodies. This underscores their commitment to adhering to various international standards and practices in financial trading, enhancing their credibility and trustworthiness as a broker.

What is the minimum deposit for BlackBull Markets?

The minimum deposit required at BlackBull Markets varies by account type. Please refer to their website for the most accurate information.

➟ Click here for more Top Broker reviews