For forex traders, a reliable calculator is essential to managing trades, calculating risk, and estimating profits with precision. While many online forex calculators offer basic features, the built-in calculators provided by top brokers stand out, offering unique tools and insights tailored to different trading needs.

Let’s take a look at what makes these broker-specific forex calculators invaluable, highlighting the unique features that set them apart.

➟ For more insights into brokers and their offerings, don’t miss our detailed reviews on Top Brokers.

What is a Forex Calculator?

A forex calculator is a tool that allows traders to quickly and accurately calculate various trade-related metrics, such as potential profit or loss, pip values, margin requirements, and leverage effects. These calculators simplify complex trading calculations and offer traders a precise understanding of risk and reward, which is essential for informed decision-making. Forex calculators are available in different forms, such as profit and loss calculators, margin calculators, pip calculators, and more, each designed to aid in a specific aspect of trade management.How Do Forex Calculators Work?

Forex calculators work by taking key inputs from the trader—such as trade size, currency pair, and leverage—and using real-time data to generate results. For example, in a margin calculator, a trader enters the trade size, currency pair, and leverage, and the calculator provides the margin required to open the position. Similarly, a pip calculator calculates the monetary value of each pip movement in a trade based on trade size and currency pair. These calculations allow traders to assess the financial impact of their decisions quickly, reducing the likelihood of miscalculations and helping traders maintain better control over their positions.IG Markets Forex Calculator: Real-Time Margin Insights

IG Markets provides a versatile forex calculator designed for all experience levels. Unlike many standard calculators, IG’s tool includes real-time data integration, which helps traders understand the immediate margin impact of any given trade based on leverage. This feature is especially useful for those trading in volatile markets, as it offers precise control over exposure and risk.

What Sets It Apart:

- Real-time margin requirement feature.

- Provides an accurate view of trading power and exposure.

- Helps traders manage positions effectively.

- Allows easy tracking of margin requirements as market conditions change.

Image Source: IG Forex Trading Calculator

➟ Read Our Full Review About IG Markets!

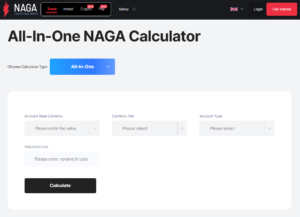

NAGA All-in-One Forex Calculator: Efficiency in One Place

The NAGA All-in-One Calculator is a streamlined tool combining multiple calculators in a single interface. Covering profit, margin, pip value, and swap calculations, it allows traders to assess all relevant metrics without switching between tools. The intuitive design and single-access point make NAGA’s calculator one of the most efficient for quick, multi-dimensional trade assessments.

What Sets It Apart:

- All-in-one design combines multiple calculations.

- Allows a quick and comprehensive overview of trade values.

- Ideal for time-sensitive trades where efficiency is key.

Image Source: NAGA All-in-One Calculator

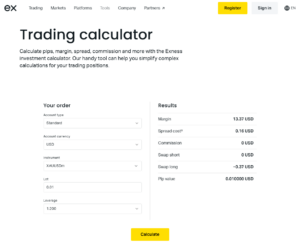

Exness Forex Calculator: Precision with Real-Time Data

Exness provides a detailed forex calculator for precise trade planning. By allowing traders to input parameters like lot size and currency pair, Exness’ calculator helps with profit, pip, and margin calculations. Real-time rate updates ensure that traders receive highly accurate results, which is crucial for those dealing with fast-moving currencies and CFD trades.

What Sets It Apart:

- Emphasizes accuracy with real-time data integration.

- Benefits traders who rely on precision for strategy development.

- Particularly appealing to advanced traders needing up-to-the-minute information.

Image Source: Exness Trading Calculator

➟ Read Our Full Review About Exness!

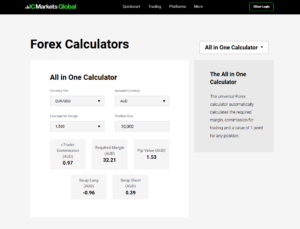

IC Markets Forex Calculators: Comprehensive Tools for Cost Management

IC Markets offers an entire suite of calculators covering everything from pip values to swap fees. Each tool is designed to help traders manage costs and optimize returns. For example, the swap calculator, which estimates overnight fees, is a powerful addition for those holding positions over longer periods. IC Markets also ensures real-time rate updates, enhancing accuracy.

What Sets It Apart:

- Includes a swap calculator to account for overnight fees.

- Beneficial for long-term traders.

- Offers transparency into the true costs of holding positions.

Image Source: IC Markets Forex Trading Calculator

➟ Read Our Full Review About IC Markets!

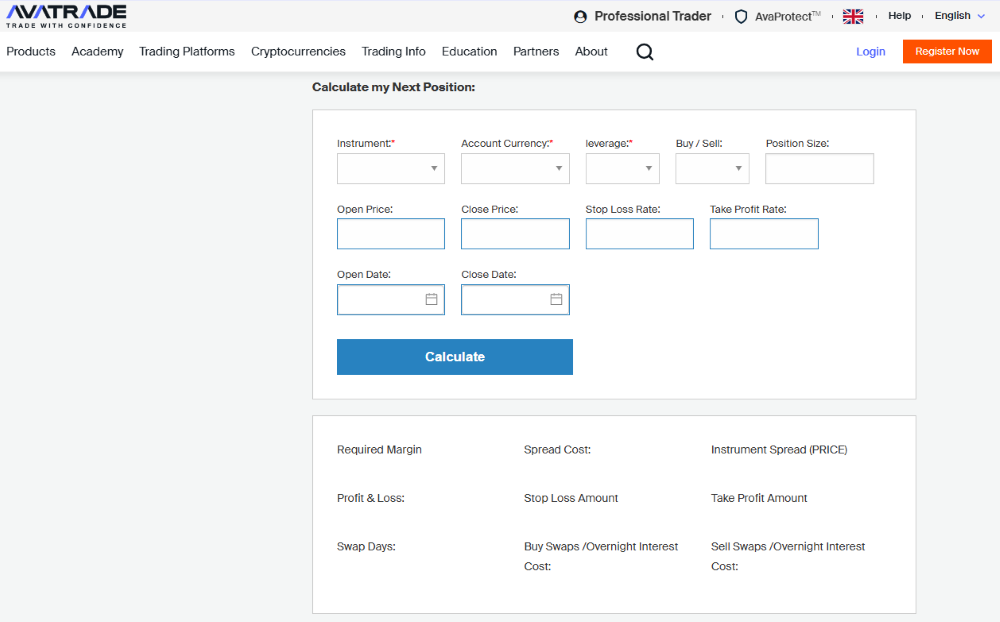

AvaTrade Trading Calculator: Focus on Risk Management

The AvaTrade Trading Calculator provides an intuitive interface for calculating margin, pip, and profit/loss, covering all the essentials for any forex trader. AvaTrade’s calculator also integrates risk assessment, allowing traders to evaluate potential profits and losses with an eye on capital protection, making it a standout tool for those who prioritize risk management.What Sets It Apart:

- Features a unique risk analysis tool.

- Measures potential returns against possible losses.

- Excellent choice for risk-focused traders, especially in volatile markets.

Image Source: AvaTrade Trading Calculator

➟ Read Our Full Review About AvaTrade!

What These Forex Brokers Offer That Others Don’t

These broker-specific forex calculators come equipped with features that make trading easier, more accurate, and better suited to diverse trading styles. Here’s why broker calculators can be more beneficial than generic online calculators:

- Real-Time Data Integration: Brokers like IG Markets and Exness provide calculators that include live data, offering more accurate results tailored to the latest market conditions.

- Comprehensive Tools in One Place: Platforms like NAGA offer all-in-one calculators, which streamline the trading experience by providing multiple metrics in a single view.

- Advanced Risk Management: Calculators from brokers like AvaTrade include risk assessment tools, allowing traders to make more informed decisions based on potential outcomes.

- Cost Transparency: With tools like IC Markets’ swap calculator, traders can account for hidden costs like overnight fees, adding clarity to long-term positions.

These calculators not only simplify trading calculations but also provide traders with the insights needed to make smarter, well-informed decisions.

Choose the Right Broker with the Tools You Need

Forex calculators are essential for managing trades effectively, and broker-specific calculators often go above and beyond what’s available with generic tools. With features like real-time data, built-in risk assessment, and comprehensive all-in-one tools, these calculators offer traders better control, precision, and transparency.

![Weekly Economic Overview [05.07.24]: S&P 500, NASDAQ, Tesla, and Apple](https://www.topbrokers360.com/wp-content/uploads/2024/07/Weekly_Update_Thumbnail_5.jpg)

![Weekly Economic Overview [28.06.24]: US Stock Market Trends, Inflation Insights, and NVIDIA Analysis](https://www.topbrokers360.com/wp-content/uploads/2024/06/Weekly_Update_Thumbnail_4.jpg)