What is CFD trading, and why has it captured the attention of investors worldwide? At its core, it involves speculating on the price movements of various financial assets, such as stocks, commodities, and currencies, without the necessity of owning them. This form of trading stands out for its flexibility, allowing participants to profit from both rising and falling markets.

Join us as we explore the ins and outs of CFD trading, setting the foundation for informed and successful trading decisions.

1. The Basics of CFD Trading

CFD trading offers an innovative way for individuals to engage with the financial markets.

How CFDs Work: Understanding the Mechanism

CFDs are agreements between traders and brokers to exchange the difference in the price of an asset from the point the contract is opened to when it is closed.

Here’s a simplified breakdown:

- Opening a Position: You speculate on whether the price of an asset will rise or fall and open a position accordingly. If you anticipate a price increase, you open a “buy” position. On the other hand, if you expect a decline, you opt for a “sell” position.

- Leverage: Trading CFDs allows the use of leverage, allowing you to control a large position with a relatively small amount of capital, magnifying both potential profits and losses.

- Closing the Position: Profit or loss is determined by the difference in the asset’s price from when the position was opened to when it was closed. You don’t own the underlying asset but you are speculating on its price movement.

Diverse Markets: From Forex to Commodities

CFDs provide access to a wide array of markets, making it possible for traders to speculate on the price movements of:

- Forex (FX): The largest and most liquid market, where currencies are traded in pairs.

- Stocks: Shares from companies around the world, offering a way to profit from the equities market without owning the shares outright.

- Indices: Benchmark index prices, such as the S&P 500 or FTSE 100, reflect the overall performance of a basket of stocks.

- Commodities: Raw materials like gold, oil, and agricultural products, which are pivotal to the global economy.

- Cryptocurrencies: Digital currencies like Bitcoin and Ethereum, are known for their volatility and potential for significant price movements.

Benefits and Risks

Benefits:

- Flexibility: Trade on both rising and falling markets across various asset classes.

- Access to Leverage: Amplify your exposure with a smaller initial investment, increasing the potential for high returns.

- Diversification: Broaden your investment portfolio by accessing different markets from a single platform.

Risks:

- Leverage Risks: While leverage can increase profits, it also amplifies losses, potentially exceeding your initial investment.

- Market Volatility: Financial markets can be unpredictable, and rapid price movements can result in significant losses.

- Gap Risk: Prices can leap from one level to another without passing through intermediate levels, potentially bypassing stop-loss orders and leading to greater losses.

Understanding these basics sets a solid foundation for understanding the complexities of the financial markets. It is crucial to approach CFD trading with a clear strategy, mindful of both its potential rewards and risks.

2. Getting Started with CFDs

Getting started on your trading journey is an exciting venture into the financial markets.

Choosing Your First CFD Broker

Selecting the right CFD broker is a pivotal step in your journey.

Here are key factors to consider:

- Regulation: Ensure the broker is regulated by reputable authorities. This adds a layer of security and trust to your trading experience.

- Trading Platform: Look for a user-friendly yet comprehensive trading platform. It should offer robust analysis tools, real-time data, and intuitive navigation.

- Fees and Spreads: Understand the cost structure, including any commissions, spreads, and overnight financing rates, to gauge how they might affect your trading profitability.

- Educational Resources: Especially important for beginners, quality educational materials and demo accounts can significantly enhance your trading skills.

- Customer Support: Reliable, accessible customer support is crucial, particularly for new traders who may need assistance navigating the platform or understanding trade specifics.

➟ Check out our broker reviews to find the right broker for you!

Setting Up Your Trading Account

After choosing a CFD broker, the next step is to set up your trading account:

- Application Process: Complete the application form on the broker’s website, providing personal information and proof of identity and residence. You can find an example here.

- Funding Your Account: Deposit funds into your account. Methods vary by broker, including bank transfers, credit cards, and e-wallets. Be mindful of deposit minimums and processing times.

- Demo Account: Start with a demo account to familiarize yourself with the trading platform and practice strategies without risking real money.

Mastering Your First Trade

Now that your account is set up, you are ready to place your first trade.

How to get started:

- Market Research: Begin with thorough market research. Understand the asset you wish to trade, current market conditions, and any influencing factors.

- Plan Your Trade: Decide on your entry and exit points, how much you are willing to risk, and your profit target. Consider using stop-loss orders to limit potential losses.

- Place Your Order: Navigate to the trading platform, select the asset you wish to trade, and specify the details of your trade (buy/sell, size, and any stop-loss or take-profit levels).

- Monitor and Close Your Trade: Keep an eye on your open position and market movements. Close your trade manually by executing an opposite order, or let your stop-loss/take-profit orders do it automatically.

Fun Fact!

Just as a physical lever allows you to lift heavy objects with less effort, trading leverage amplifies your trading power, opening up more significant potential gains (and losses) without the need for substantial capital.

By carefully choosing a reputable CFD broker, setting up your account correctly, and approaching your first trade with a well-thought-out strategy, you set the stage for a potentially rewarding trading journey. Remember, continuous learning and disciplined trading are key to long-term success in the CFD market.

3. Essential Tools for CFD Trading

Equipping yourself with the right tools is crucial. From choosing the best trading platform to using analytical tools and practicing with demo accounts, each component plays an important role in crafting successful trading strategies.

Understanding CFD Trading Platforms

A CFD trading platform is your gateway to the markets, and selecting one that aligns with your needs is vital:

- User Interface: Look for a platform with an intuitive interface, making it easy to monitor markets, execute trades, and manage your portfolio.

- Speed and Reliability: In fast-moving markets, the speed of executing trades and the reliability of the platform are non-negotiable.

- Tools and Features: Ensure the platform offers extensive charting tools, real-time news feeds, and automatic trading options to support your trading decisions.

- Accessibility: Consider platforms that offer mobile trading options, allowing you to trade on the go and stay connected to the markets.

Analytical Tools and Indicators

The ability to analyze market trends and make informed decisions is what sets successful traders apart. Utilize these analytical tools:

- Charting Tools: Use charting tools to visualize market trends and patterns over various time frames.

- Technical Indicators: Indicators like Moving Averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) can help predict future market movements.

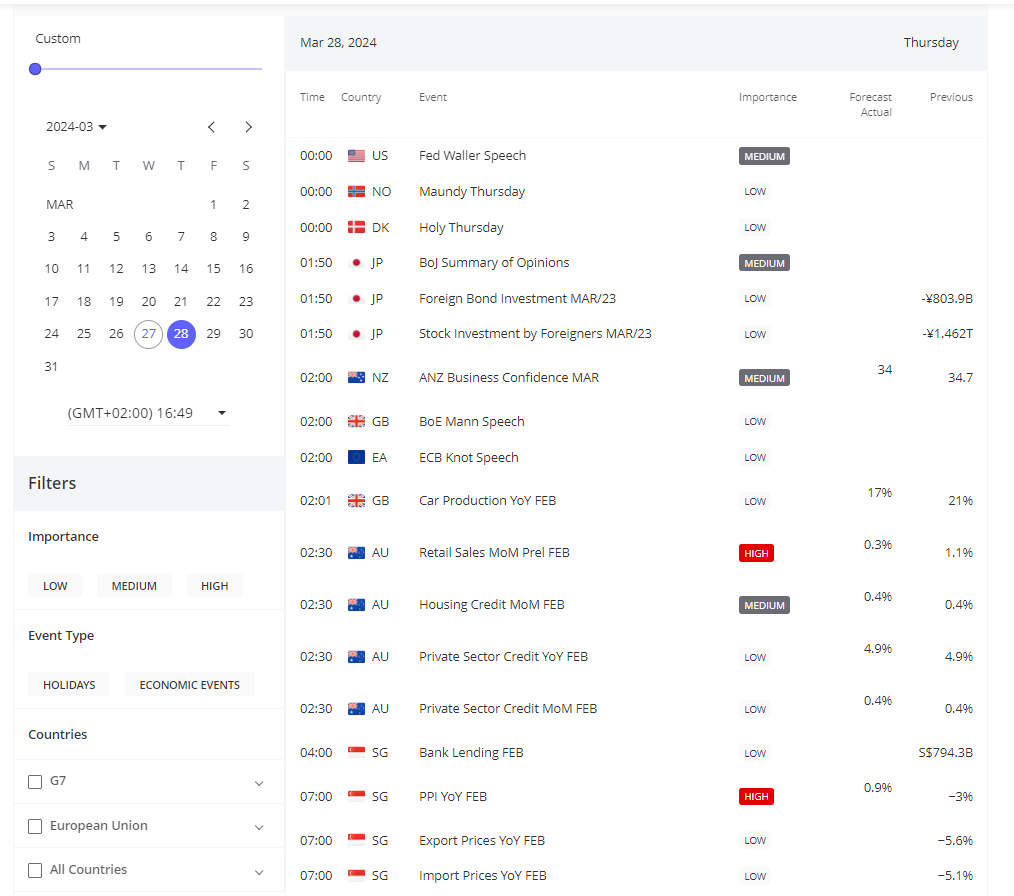

- Economic Calendars: Keep an eye on upcoming economic events that could impact market volatility and plan your trades accordingly.

Image Source: Tools like Economic Calendars can assist you in your trading journey

Using Demo Accounts for Practice

Demo accounts serve as an invaluable tool for both beginners and experienced traders:

- Risk-Free Environment: Practice trading strategies in a simulated environment without risking real money.

- Platform Familiarization: Get comfortable with the trading platform’s features and tools, helping you navigate real trades more confidently.

- Strategy Testing: Test and refine your trading strategies to see what works best for you without any financial commitment.

Fun Fact!

Embracing these essential tools can significantly improve your journey, offering a blend of practical experience, insightful analysis, and strategic execution. Remember, the most successful traders are not just those who can predict market movements, but also those who are well-prepared, using every tool at their disposal to make informed decisions.

4. Strategies for Successful CFD Trading

To work through the complex world of CFD trading effectively, adopting proven strategies and techniques is essential.

Develop a Trading Plan

A trading plan serves as your personal roadmap in the markets, outlining your goals, strategies, risk tolerance, and criteria for entering and exiting trades.

How to start building your plan:

- Set Clear Goals: Define what you want to achieve through your trading activities, such as a specific return on investment or educational milestones.

- Choose Your Markets: Decide which markets or assets you will trade based on your research, interests, and market conditions.

- Define Entry and Exit Criteria: Establish clear criteria for when to enter and exit trades, including technical indicators or news events that trigger your actions.

- Risk Management Rules: Set rules for how much of your portfolio to risk on a single trade and daily loss limits to protect your capital.

- Review and Adjust: Regularly review your trading plan’s performance and adjust your strategies as needed.

Risk Management Techniques

Effective risk management is crucial to preserve capital and ensure a long trading career.

Key techniques to consider:

- Stop-Loss Orders: Set stop-loss orders to automatically close a position at a predetermined price level, limiting your potential losses.

- Position Sizing: Determine the size of your positions based on your risk tolerance and the specific trade’s risk to keep potential losses within acceptable limits.

- Diversification: Spread your investments across different markets or assets to reduce the impact of poor performance in any single trade.

| Technique | Description | Purpose |

| Stop-Loss Orders | Automatic closure of a position at a set price | Limit potential losses |

| Position Sizing | Calculating the size of a trade | Keep losses within acceptable limits |

| Diversification | Investing in various markets/assets | Reduce the risk of significant losses |

Advanced Trading Strategies

Once you have mastered the basics, consider these advanced strategies to further your trading capabilities:

- Scalping: A strategy that involves making numerous trades to capture small price changes, requiring a significant time commitment and attention to market movements.

- Swing Trading: This approach focuses on capturing price movements within a larger trend over days or weeks, requiring patience and an understanding of market patterns.

- Hedging: Using CFDs to hedge your portfolio can protect against adverse price movements in your long-term investments, effectively balancing potential risks and rewards.

Implementing these strategies within the framework of your trading plan, while adhering to strict risk management rules, can significantly increase your chances of success in CFD trading. Remember, the key to longevity and profitability in trading lies in continuous learning, discipline, and the ability to adapt to changing market conditions.

5. Choosing the Best CFD Broker

Selecting the right CFD broker is a critical decision that can significantly impact your trading experience and success. A suitable broker not only provides a reliable platform for executing trades but also offers the support, resources, and conditions necessary to foster a productive trading environment.

What Makes a CFD Broker the Best?

Several key factors contribute to a CFD broker’s standing as the best choice for traders:

- Regulation and Security: Top brokers are regulated by reputable financial authorities, ensuring transparency and security for your funds.

- Trading Platform and Technology: The availability of a user-friendly, advanced trading platform that offers reliable execution and real-time data is crucial.

- Customer Support: Exceptional customer service, such as that provided by BlackBull Markets, ensures that traders receive timely assistance and support for their queries and concerns.

- Educational Resources: A broker that offers extensive learning materials and tools can significantly enhance your trading knowledge and skills.

Comparing Fees, Features, and Support

When choosing your broker, consider how their fees, features, and support stack up.

| Feature | Importance | Example Broker |

| Regulatory Oversight | Ensures broker credibility and security | Maunto |

| Trading Platform | Affects trade execution and analysis | AvaTrade |

| Customer Support | Vital for resolving issues and queries | BlackBull Markets |

| Educational Resources | Helps in improving trading knowledge and skills | FXNovus |

| Fees | Impacts overall profitability | Interactive Brokers |

Choosing a CFD broker is a personal journey that depends on a careful assessment of various factors. By considering what makes a broker stand out, comparing their offerings, and paying close attention to reviews and recommendations, you can find a partner that aligns with your trading goals and preferences.

Quick Tip!

6. Common Pitfalls When Trading CFDs

Understanding more about CFD trading requires awareness and strategic foresight to avoid common pitfalls that can hinder success.

The Dangers of Overleveraging

Leverage allows traders to open larger positions with a relatively small amount of capital, significantly amplifying the potential for profit—and loss. Overleveraging occurs when traders take on too much risk, exposing them to the danger of substantial losses, sometimes exceeding their initial investment.

How can you avoid this?

- Risk Management: Implement strict risk management rules, determining in advance the maximum percentage of capital to risk on a single trade.

- Position Sizing: Calculate the appropriate position size for each trade based on your risk tolerance and the specifics of the trade.

- Use of Stop-Loss Orders: Always use stop-loss orders to limit potential losses to manageable amounts.

Emotional Trading & How to Avoid It

Emotional trading — making decisions based on fear, greed, or other emotions, rather than on rational analysis — can lead to impulsive actions and undermine trading strategies.

- Develop a Plan: Stick to a well-thought-out trading plan that outlines your strategies, entry and exit points, and risk management rules.

- Maintain Discipline: Discipline is the key to success. Stick to your trading plan and resist the urge to make impulsive decisions.

- Take Breaks: Regular breaks can help clear your mind, reducing the likelihood of emotional decision-making.

The Importance of Continuous Learning

The financial markets are dynamic, with new trends, tools, and strategies emerging regularly. Continuous learning is essential to stay ahead in the game and adapt to these changes effectively.

- Follow Market News: Stay updated with the latest market news and how it might impact your trading decisions.

- Educational Resources: Utilize the educational resources provided by your broker, and seek out books, courses, and webinars to enhance your knowledge.

- Practice: Use demo accounts to try new strategies without risk, allowing you to learn from both successes and failures.

Quick Tip!

Avoiding the common mistakes in CFD trading requires a disciplined approach, a commitment to risk management, and an ongoing dedication to learning and self-improvement. By recognizing and addressing these challenges, traders can enhance their prospects for success and achieve long-term growth in their trading careers.

Building Your Path to Success in CFD Trading

As we finish our journey through the essentials of CFD trading, it is clear that success in this arena is not just about understanding the market mechanics or choosing the right broker. It involves a holistic approach that combines strategic planning, rigorous risk management, emotional discipline, and a commitment to continuous learning. No matter your expertise in the industry, the keys to success remain the same: knowledge, preparation, and persistence.

Remember, each trade is an opportunity to learn and grow. By applying the principles outlined in this guide, you are setting a solid foundation for a rewarding CFD trading journey. Keep exploring, stay disciplined, and let your trading journey be guided by informed decisions and strategic thinking.

![Weekly Economic Overview [05.07.24]: S&P 500, NASDAQ, Tesla, and Apple](https://www.topbrokers360.com/wp-content/uploads/2024/07/Weekly_Update_Thumbnail_5.jpg)

![Weekly Economic Overview [28.06.24]: US Stock Market Trends, Inflation Insights, and NVIDIA Analysis](https://www.topbrokers360.com/wp-content/uploads/2024/06/Weekly_Update_Thumbnail_4.jpg)